Why is Michigan automotive insurance coverage so costly? It is a query plaguing many Michiganders. This deep dive explores the elements behind Michigan’s hefty auto insurance coverage premiums, evaluating them to different states. We’ll uncover the distinctive rules, declare histories, and market dynamics that contribute to the excessive prices.

Michigan’s insurance coverage panorama is a posh mixture of state rules, driving behaviors, and market forces. Understanding these parts is vital to navigating the often-confusing world of automotive insurance coverage within the mitten state. This evaluation will enable you make knowledgeable selections about your protection.

Components Influencing Michigan Auto Insurance coverage Prices: Why Is Michigan Automotive Insurance coverage So Costly

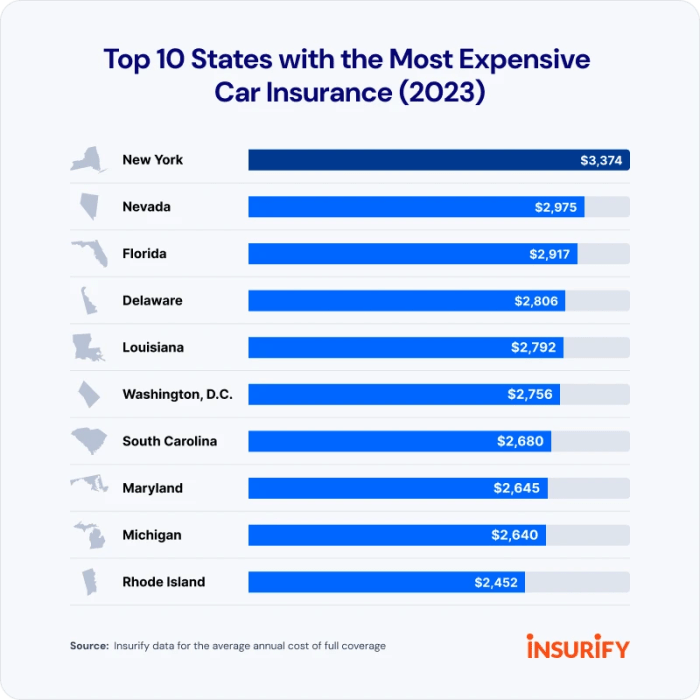

Michigan’s auto insurance coverage premiums usually rank among the many highest within the nation, a state of affairs influenced by a posh interaction of things. These elements, whereas not distinctive to Michigan, manifest in ways in which contribute to a better price of protection. Understanding these parts is essential for comprehending the challenges confronted by Michigan drivers.

Geographic Components and Declare Frequency

Michigan’s various geography performs a big function in shaping insurance coverage prices. The state’s mixture of rural and concrete areas, mixed with its difficult winter circumstances, contributes to a better frequency of accidents and claims. Extreme climate occasions, reminiscent of blizzards and ice storms, often disrupt transportation, resulting in extra accidents. Moreover, the prevalence of icy roads and poor visibility will increase the danger of collisions, thereby elevating insurance coverage charges for all drivers within the state.

This contrasts with states with much less excessive climate patterns or a higher emphasis on driving on clear roads.

Driving Behaviors and Security Report

Driving behaviors considerably affect insurance coverage premiums in Michigan, as in different states. Excessive charges of rushing, reckless driving, and aggressive maneuvers contribute to a better danger profile for insurers. Michigan, like different states, implements a system the place drivers with a historical past of visitors violations or accidents face increased premiums. This displays the insurer’s must handle danger successfully.

For instance, a driver with a number of rushing tickets will probably face a better premium than a driver with a clear report. Equally, accidents, particularly these leading to accidents or important property injury, will affect the driving force’s insurance coverage charges in the long run.

Demographic Components and Driving Historical past, Why is michigan automotive insurance coverage so costly

Demographics additionally contribute to Michigan’s auto insurance coverage panorama. Age, location, and driving historical past all play a vital function in figuring out premiums. Youthful drivers, usually perceived as increased danger, usually face considerably increased premiums. That is partly as a result of their inexperience and doubtlessly increased propensity for accidents. Moreover, drivers residing in areas with increased accident charges or crime charges would possibly expertise elevated premiums.

The driving historical past of a driver, together with any prior accidents or visitors violations, instantly influences the premium. Insurers use this information to evaluate the danger related to insuring a selected driver.

State Rules and Monetary Stability

Michigan’s particular rules and the monetary stability of insurance coverage corporations are essential elements in figuring out premiums. The state’s rules, whereas supposed to guard shoppers, could have an effect on the general price of insurance coverage. Variations in state rules throughout the nation contribute to the variation in insurance coverage charges. As an example, states with stricter rules on minimal protection quantities could result in increased premiums.

Insurers assess the monetary well being and stability of corporations earlier than providing protection. Insurers with a stronger monetary place could provide extra aggressive charges. The state’s rules on the quantity of protection required for drivers additionally performs a task.

Desk: Important Components Influencing Michigan Auto Insurance coverage Prices

| Issue | Description | Affect on Premiums |

|---|---|---|

| Geographic Components | Mixture of rural and concrete areas, difficult winter circumstances | Larger declare frequency, elevated danger of accidents |

| Driving Behaviors | Dashing, reckless driving, aggressive maneuvers | Elevated danger profile, increased premiums |

| Demographic Components | Age, location, driving historical past | Youthful drivers and drivers in high-risk areas face increased premiums |

| State Rules | Minimal protection quantities, different rules | Affect total price of insurance coverage, doubtlessly impacting charges |

| Monetary Stability of Insurance coverage Firms | Monetary power and stability of insurers | Stronger monetary place can result in extra aggressive charges |

Particular Rules and Legal guidelines in Michigan

Michigan’s auto insurance coverage panorama is formed by a posh interaction of state rules and legal guidelines, considerably impacting the premiums drivers pay. These rules, usually influenced by the necessity for monetary accountability and public security, create a framework that insurers use to evaluate danger and calculate premiums. Understanding these particular rules is essential to comprehending the general price of insurance coverage within the state.

Monetary Accountability Legal guidelines

Michigan’s monetary accountability legal guidelines mandate that drivers preserve sufficient legal responsibility insurance coverage protection to guard themselves and others in case of accidents. Failure to conform leads to penalties, together with suspension of driving privileges. This authorized requirement instantly influences insurance coverage premiums. Drivers with a historical past of accidents or violations, or those that have had their driving privileges suspended for failing to take care of adequate insurance coverage, face considerably increased premiums.

Insurers view these drivers as higher-risk people, necessitating a better premium to offset the potential monetary burden. The state’s monetary accountability legal guidelines, coupled with the penalties for non-compliance, create a system the place sustaining insurance coverage is essential for each the driving force and the insurance coverage firm.

No-Fault Insurance coverage

Michigan’s no-fault insurance coverage system performs a pivotal function in figuring out the price of auto insurance coverage. Beneath this technique, the injured occasion in an accident receives compensation from their very own insurer, no matter fault. This technique impacts premiums by requiring insurers to cowl claims for accidents and property injury no matter fault. Whereas defending shoppers, it does affect the price of insurance coverage, as insurers must account for a wider vary of potential claims of their premium calculations.

The no-fault system, by design, shifts the main focus from figuring out fault to compensating the injured occasion promptly.

Minimal Protection Necessities

Michigan has established minimal protection necessities for auto insurance coverage insurance policies. These minimums, which differ based mostly on the kind of coverage, affect the price of insurance coverage. Insurance policies with decrease minimums, although assembly the authorized necessities, would possibly expose the insured to higher danger ought to an accident happen. This instantly impacts insurers, as they’ve to make sure that the premiums for these insurance policies can nonetheless cowl potential claims inside the required minimums.

For instance, insurance policies falling beneath the minimal necessities may end in increased premiums to make sure the corporate can nonetheless meet its contractual obligations to the insured.

Desk of Particular Rules and Their Affect

| Regulation | Description | Affect on Price |

|---|---|---|

| Monetary Accountability Legal guidelines | Drivers should preserve sufficient legal responsibility insurance coverage. | Larger premiums for drivers with a historical past of accidents or violations; increased premiums for insurance policies falling beneath minimums. |

| No-Fault Insurance coverage | Injured events obtain compensation from their very own insurer, no matter fault. | Elevated premiums to cowl potential claims, no matter fault. |

| Minimal Protection Necessities | State-mandated minimums for legal responsibility and different coverages. | Premiums could also be decrease if insurance policies meet minimums, however increased danger to the insured if insurance policies fall beneath minimums. |

| Current Legislative Adjustments | Laws impacting price changes or particular coverages. | Adjustments can affect the price based mostly on the character of the adjustments, reminiscent of introducing new rules or modifying current ones. |

Comparability to Different States

Michigan’s auto insurance coverage rules, together with its no-fault system and minimal protection necessities, differ from these in different states. This variation in rules results in differing premium constructions. Evaluating Michigan to states with comparable demographics and accident charges, like these within the Midwest, reveals variations in premium ranges, reflecting the distinctive traits of every state’s insurance coverage market. This comparability underscores how particular rules considerably affect the general price of insurance coverage inside a specific state.

Claims Historical past and Frequency

Michigan’s auto insurance coverage premiums are considerably influenced by the frequency and severity of claims filed. Understanding the connection between claims historical past and insurance coverage prices is essential for assessing the general insurance coverage panorama and its affect on drivers. This part delves into the specifics of declare frequency in Michigan, evaluating it to different states, and analyzing how accident severity and former claims affect future premiums.

Relationship Between Declare Frequency and Insurance coverage Prices

Declare frequency, the speed at which insurance coverage claims are filed, is a significant component in figuring out insurance coverage premiums. Excessive declare frequency signifies a better danger for insurers, prompting them to regulate premiums upward to cowl potential losses. Conversely, low declare frequency suggests a decrease danger, resulting in doubtlessly decrease premiums. This correlation between declare frequency and insurance coverage price is a elementary precept in actuarial science, which insurers use to evaluate danger and set applicable premiums.

Comparability of Claims Frequency Knowledge in Michigan to Different States

Direct, publicly obtainable comparative information on declare frequency throughout states is commonly restricted. Nevertheless, basic tendencies might be noticed. Michigan, together with different states experiencing excessive inhabitants density, doubtlessly increased charges of visitors congestion, or recognized climate patterns contributing to extra accidents, usually see increased declare frequencies in comparison with states with decrease inhabitants density or much less excessive climate.

Detailed evaluation of particular declare information for Michigan requires accessing insurance coverage trade studies and information units, which will not be available to the general public.

Affect of Accident Severity on Insurance coverage Charges

The severity of accidents considerably impacts insurance coverage charges. A minor fender bender leads to a comparatively low declare price in comparison with a critical collision or a multi-vehicle accident. The severity of the accident, together with the extent of accidents, property injury, and different elements, instantly influences the declare quantity. Insurers use statistical fashions to account for the severity of claims when calculating premiums, guaranteeing that premiums mirror the true danger related to various kinds of accidents.

Affect of Earlier Claims Historical past on Future Premiums

A driver’s earlier claims historical past is a vital consider figuring out future premiums. Drivers with a historical past of frequent claims are thought-about higher-risk, resulting in increased premiums. Insurers analyze declare information to determine patterns and predict future declare frequency. The variety of claims, the kind of claims, and the time interval over which claims occurred all contribute to the danger evaluation.

For instance, a driver with a number of claims inside a brief interval could also be assigned a better danger score than a driver with a single declare years in the past.

Correlation Between Claims Frequency and Insurance coverage Prices in Michigan

A direct, definitive correlation between declare frequency and insurance coverage price is complicated for instance with a easy desk, as varied different elements affect pricing. Nevertheless, a basic development is observable. Larger declare frequencies in Michigan usually correlate with increased insurance coverage prices. A simplified desk can solely characterize a restricted perspective.

| Declare Frequency (per 100 drivers) | Estimated Affect on Premium (approximate share improve) |

|---|---|

| Low (e.g., <10) | Minimal (0-5%) |

| Average (e.g., 10-20) | Average (5-15%) |

| Excessive (e.g., >20) | Important (15%+ improve) |

Visible Illustration of Declare Knowledge Over Time in Michigan

A visible illustration of declare information over time in Michigan, doubtlessly utilizing a line graph, may present tendencies in declare frequency. The x-axis would characterize time (e.g., years), and the y-axis would characterize the variety of claims per interval (e.g., per 100 drivers). This visible help may spotlight durations of upper or decrease declare frequency and doubtlessly present correlations with exterior elements reminiscent of financial circumstances, climate patterns, or adjustments in visitors legal guidelines.

Knowledge would must be rigorously interpreted and introduced with correct context to keep away from deceptive conclusions.

Availability and Competitors within the Market

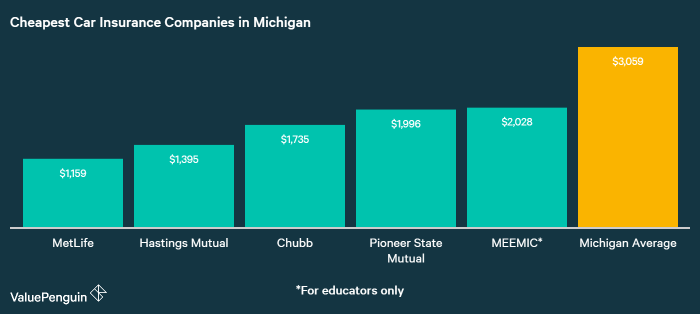

The supply and degree of competitors amongst insurance coverage suppliers considerably affect Michigan auto insurance coverage prices. A aggressive market, with a number of suppliers providing varied plans, usually results in decrease costs and extra selections for shoppers. Conversely, restricted competitors usually leads to increased premiums and diminished shopper choices. Understanding these dynamics is essential for comprehending the general price construction of Michigan auto insurance coverage.The Michigan auto insurance coverage market presents a combined image when it comes to competitors.

Whereas a number of massive nationwide carriers function within the state, the presence of smaller, regional insurers varies. This uneven distribution of suppliers can have an effect on the general aggressive panorama, doubtlessly impacting value sensitivity and shopper alternative.

Stage of Competitors

The extent of competitors amongst insurance coverage suppliers in Michigan varies by area and particular varieties of protection. Whereas main nationwide gamers preserve a robust presence, smaller, domestically centered corporations could provide extra tailor-made plans and doubtlessly aggressive charges. Nevertheless, the shortage of a extremely fragmented market, not like another states, may restrict the extent of value differentiation amongst suppliers.

Components Influencing Availability

A number of elements affect the supply of insurance coverage choices in Michigan. These embody regulatory necessities, profitability issues, and the presence of state-specific mandates. For instance, necessary minimal protection necessities can affect the viability of some protection choices for smaller corporations. The price of claims processing and adjusting in Michigan, in addition to the general monetary stability of insurers, additionally performs a task.

Pricing and Protection Variations

Important variations in pricing and protection exist amongst varied suppliers. These variations stem from elements reminiscent of danger evaluation methodologies, underwriting practices, and claims expertise. Insurers make use of completely different algorithms to calculate danger profiles for particular person drivers, and these algorithms could take into account elements like driving historical past, location, car kind, and even age. These discrepancies can result in substantial value variations for comparable protection.

Completely different suppliers may additionally provide varied add-on coverages or reductions, additional complicating comparisons.

Affect of Restricted Competitors

Restricted competitors instantly impacts shopper selections and prices. When fewer suppliers are current, shoppers face a diminished vary of choices and could also be unable to safe probably the most favorable charges. This state of affairs can result in increased premiums as suppliers can set costs with much less concern for market pressures. It additionally limits shoppers’ potential to buy round for the very best deal.

Geographic Variations

Geographic variations in insurance coverage availability and pricing are noticeable in Michigan. Areas with increased charges of accidents or particular demographic profiles would possibly expertise increased premiums in comparison with areas with decrease accident charges. Rural areas, specifically, could have restricted insurer availability, as the price of servicing these areas can outweigh the potential income.

Pricing Comparability

| Insurance coverage Supplier | Premium for Primary Legal responsibility Protection (Instance) | Premium for Complete Protection (Instance) |

|---|---|---|

| Insurer A | $1,200 | $1,800 |

| Insurer B | $1,150 | $1,750 |

| Insurer C | $1,350 | $2,000 |

| Insurer D | $1,280 | $1,900 |

Word: These figures are illustrative examples and don’t characterize precise premiums. Premiums can differ considerably based mostly on particular person driver profiles and particular protection picks. Knowledge for this desk is hypothetical and doesn’t mirror particular market circumstances.

Kinds of Protection and Their Affect

Michigan auto insurance coverage premiums are influenced considerably by the varieties of protection chosen. Understanding the assorted protection choices and their related prices is essential for making knowledgeable selections. Completely different ranges of protection translate to various ranges of economic safety within the occasion of an accident or injury to your car.

Overview of Out there Protection Sorts

Michigan drivers have entry to a variety of protection sorts, every designed to handle particular dangers. Elementary protection choices embody legal responsibility, collision, and complete. Legal responsibility protection protects in opposition to damages you trigger to others, whereas collision protection pays for damages to your car no matter who’s at fault. Complete protection, then again, compensates for injury to your car from non-collision occasions, reminiscent of theft, vandalism, or climate occasions.

Affect of Protection Decisions on Premiums

The number of protection sorts and ranges instantly impacts insurance coverage premiums. Larger ranges of protection usually end in increased premiums, as they supply broader monetary safety. For instance, a coverage with increased legal responsibility limits and complete protection will typically be dearer than one with solely primary legal responsibility protection. It is because the insurer assumes higher danger with extra complete protection.

The price of insurance coverage is in the end a stability between the extent of safety desired and the related monetary burden.

Price Implications of Completely different Protection Ranges

The price of varied protection choices varies significantly. Legal responsibility protection, probably the most primary type of safety, typically carries the bottom premium. Including collision and complete protection considerably will increase the price. The extent of the protection (e.g., legal responsibility limits) additional impacts the premium. Larger legal responsibility limits imply higher monetary accountability for the insurer, therefore the upper premium.

Correlation Between Protection and Declare Chance

A powerful correlation exists between the selection of protection and the chance of accidents and claims. Drivers with complete and collision protection are much less more likely to expertise important monetary losses within the occasion of an accident or injury. Complete and collision protection usually results in fewer claims, because the insurance coverage firm instantly compensates for damages to the insured car, decreasing the monetary burden on the driving force.

Drivers with solely legal responsibility protection are extra weak to substantial out-of-pocket bills within the occasion of an accident.

Comparative Price Evaluation of Protection Choices

The desk beneath presents a basic comparability of protection choices and their estimated prices for the standard driver in Michigan. Word that these figures are estimates and precise prices could differ based mostly on particular person circumstances.

| Protection Sort | Description | Estimated Price (per yr) |

|---|---|---|

| Legal responsibility Solely | Covers damages to others in an accident the place you’re at fault. | $500 – $1500 |

| Legal responsibility + Collision | Covers damages to your car and to others in an accident the place you’re at fault. | $1000 – $2500 |

| Legal responsibility + Collision + Complete | Covers damages to your car and to others, no matter fault, and for non-collision occasions. | $1500 – $3500 |

Word: These are estimates. Precise prices will rely upon elements reminiscent of driving report, car kind, location, and deductibles.

Function of Insurance coverage Firms in Michigan

Insurance coverage corporations play a vital function within the Michigan auto insurance coverage market, appearing as intermediaries between drivers and the potential monetary dangers related to automotive accidents. Their operations embody danger evaluation, premium calculation, claims processing, and total market stability. Understanding their practices and methods is essential in analyzing the excessive price of insurance coverage within the state.Pricing methods employed by Michigan insurance coverage corporations are multifaceted and complicated.

These methods usually contain a mixture of things, together with actuarial evaluation of accident information, demographics of drivers in particular areas, and the price of claims settlements. Insurance coverage corporations goal to stability profitability with affordability, a stability usually tough to realize within the context of excessive accident charges or particular regulatory necessities.

Pricing Methods and Strategies

Insurance coverage corporations use varied strategies to find out premiums, usually incorporating a complicated mix of knowledge factors. A key issue is the evaluation of historic claims information, which permits corporations to determine high-risk drivers or geographic areas susceptible to accidents. Moreover, driver demographics reminiscent of age, driving historical past, and site are factored into the calculation. Premium calculations additionally take into account the kind of car insured, protection ranges chosen, and the monetary stability of the insurance coverage firm itself.

This intricate course of ensures that corporations are adequately compensated for the danger they assume.

Monetary Stability and Status of Firms

The monetary stability and status of insurance coverage corporations considerably affect the pricing of auto insurance coverage in Michigan. Firms with a robust monetary score, as decided by impartial businesses like A.M. Greatest or Commonplace & Poor’s, usually provide decrease premiums as a result of their potential to deal with potential claims. Conversely, corporations with weaker rankings would possibly cost increased premiums to compensate for a perceived increased danger of insolvency.

This danger evaluation displays the arrogance of the insurance coverage market and the shoppers counting on these corporations to satisfy their obligations.

Comparability of Pricing Methods

Direct comparability of pricing methods amongst Michigan insurance coverage corporations reveals appreciable variance. Components like the precise actuarial fashions employed, the goal buyer base, and the geographic focus of every firm affect their pricing selections. Some corporations would possibly deal with providing decrease premiums for particular demographic teams, whereas others would possibly prioritize complete protection packages at increased value factors. The market competitors is a vital factor on this dynamic pricing panorama.

Examples of Firm Practices Contributing to Prices

A number of practices contribute to the price of automotive insurance coverage in Michigan. For instance, the rising price of medical care following accidents instantly impacts claims settlements, doubtlessly rising premiums. Equally, rising fraud charges in insurance coverage claims require corporations to include further safeguards and modify pricing accordingly. Moreover, regulatory necessities, reminiscent of these associated to minimal protection ranges, additionally play a big function in influencing pricing.

Abstract of Main Insurance coverage Firms in Michigan

| Firm | Monetary Ranking (e.g., A.M. Greatest) | Pricing Technique Focus | Protection Choices |

|---|---|---|---|

| Firm A | A++ | Aggressive pricing, complete protection | Full protection choices, reductions for secure drivers |

| Firm B | A+ | Emphasis on bundling insurance coverage merchandise | Number of packages, deal with multi-policy reductions |

| Firm C | A | Give attention to particular demographics (younger drivers, and many others.) | Tailor-made protection choices, potential for increased premiums for particular teams |

Word: Monetary rankings are illustrative and ought to be verified instantly from respected score businesses. The desk represents a generalized comparability and doesn’t embody each insurance coverage firm working in Michigan. Pricing methods and protection choices are topic to alter.

Ending Remarks

In conclusion, Michigan’s automotive insurance coverage prices stem from a mixture of things, together with particular rules, declare frequency, and market dynamics. Whereas the explanations are multifaceted, understanding these parts can empower you to decide on the fitting protection on the proper value. Armed with this information, you may make savvy selections to navigate Michigan’s insurance coverage market.

Questions and Solutions

What in regards to the impact of climate on insurance coverage charges?

Michigan’s harsh winters and doubtlessly hazardous highway circumstances contribute to increased insurance coverage premiums. Extra accidents and claims associated to winter driving can push up common prices for everybody.

How does my driving report have an effect on my insurance coverage?

A clear driving report with no accidents or visitors violations typically results in decrease premiums. Conversely, previous incidents, like rushing tickets or accidents, considerably affect charges.

Are there any reductions obtainable?

Sure, many insurers provide reductions for secure driving, good scholar standing, and defensive driving programs. Investigating obtainable reductions can doubtlessly decrease your premium.

How does competitors have an effect on insurance coverage costs?

Restricted competitors within the insurance coverage market can result in increased costs for shoppers. A extra aggressive market usually leads to extra selections and higher pricing.