Suppose that you simply work for Gecko Automotive Insurance coverage. This in-depth look reveals the intricacies of Gecko’s insurance policies, customer support, pricing, and declare course of. From understanding their distinctive promoting propositions to navigating the most recent trade developments, this unique interview-style exploration gives a complete perspective.

This evaluation delves into Gecko’s target market, evaluating their choices with a number one competitor, and outlining numerous coverage sorts and coverages. We’ll discover their customer support channels, pricing methods, and the steps concerned in submitting and resolving claims. Lastly, we’ll study Gecko’s strategy to security options and driving habits, highlighting their modern methods within the dynamic insurance coverage market.

Gecko Automotive Insurance coverage Overview: Suppose That You Work For Gecko Automotive Insurance coverage

A nimble gecko, swift and positive, embodies the spirit of Gecko Automotive Insurance coverage. This modern firm gives a refreshing strategy to auto insurance coverage, specializing in tailor-made options for drivers of all types. Its user-friendly on-line platform and dedication to clear pricing set it aside within the aggressive market.Gecko Automotive Insurance coverage prioritizes proactive customer support, fostering a way of neighborhood and belief amongst its policyholders.

This dedication to particular person wants, mixed with aggressive charges, makes Gecko a compelling selection for these in search of each affordability and safety on the highway.

Distinctive Promoting Propositions (USPs)

Gecko Automotive Insurance coverage distinguishes itself by means of a mix of modern options. Its dedication to customized pricing fashions, primarily based on particular person driving behaviors and automobile specifics, permits for personalized protection. Moreover, Gecko makes use of cutting-edge expertise to streamline the claims course of, offering a seamless expertise for policyholders.

Goal Viewers

The target market for Gecko Automotive Insurance coverage spans a broad spectrum of drivers. From younger, tech-savvy millennials to seasoned, value-conscious drivers, Gecko’s complete and adaptable insurance policies cater to numerous wants and existence. Emphasis is positioned on accessibility and ease of use, making the insurance coverage course of much less daunting and extra empowering for all.

Key Options and Advantages

Gecko Automotive Insurance coverage insurance policies supply a variety of advantages designed to boost the driving expertise. Complete protection, together with legal responsibility, collision, and complete safety, ensures peace of thoughts on the highway. Versatile protection choices cater to various budgets and driving habits. This customized strategy allows policyholders to tailor their insurance coverage to particular wants. The web platform supplies 24/7 entry to coverage data and claims administration.

- Personalised Pricing: Gecko’s dynamic pricing mannequin adjusts premiums primarily based on elements comparable to driving historical past, automobile kind, and site. This ensures drivers pay just for the protection they want.

- Straightforward On-line Platform: A user-friendly on-line portal streamlines your entire insurance coverage course of, from coverage buy to assert submitting. Policyholders can entry data, handle their accounts, and observe claims progress effortlessly.

- Proactive Buyer Service: Gecko Automotive Insurance coverage fosters a robust relationship with its prospects by means of responsive and useful help channels. This dedication to buyer satisfaction supplies a way of safety and reliability.

Model Identification and Values

Gecko Automotive Insurance coverage cultivates a model identification rooted in innovation, accessibility, and transparency. The corporate values buyer empowerment and strives to supply a streamlined, user-friendly expertise. This emphasis on simplicity and effectivity is a core tenet of their model ethos.

Comparability with State Farm

| Function | Gecko | State Farm | Abstract |

|---|---|---|---|

| Pricing | Dynamic, customized, primarily based on particular person elements | Conventional, standardized charges | Gecko gives tailor-made pricing, whereas State Farm makes use of a extra common strategy. |

| Platform | Person-friendly, online-centric | Mixture of on-line and conventional channels | Gecko prioritizes a digital expertise, whereas State Farm makes use of a broader array of strategies. |

| Buyer Service | Proactive, responsive, simply accessible | Usually dependable, however could have various response instances | Gecko emphasizes proactive help, whereas State Farm operates on a extra conventional mannequin. |

| Protection Choices | Versatile, adaptable to particular person wants | Complete, however could not supply as a lot customization | Gecko gives tailor-made choices, whereas State Farm supplies a wider vary of complete protection. |

Coverage Varieties and Protection

A tapestry of safety, woven from threads of numerous protection, awaits those that search solace in Gecko’s embrace. Understanding the nuances of every coverage kind is vital to securing the optimum safeguard in your cherished automobile. From the common-or-garden commuter automobile to the spirited sports activities machine, Gecko gives tailor-made insurance policies to go well with each want.Gecko’s insurance coverage insurance policies are designed to be extra than simply monetary devices; they’re shields towards life’s sudden turns.

Every coverage kind rigorously balances complete safety with affordability, permitting you to navigate the roads with confidence. The next sections will element the assorted insurance policies and their respective protection, empowering you to make knowledgeable selections about your automobile’s safety.

Coverage Variations

Gecko gives a spectrum of coverage sorts, every meticulously crafted to handle distinctive circumstances. These insurance policies are categorized to cater to the distinct wants of varied drivers and automobile sorts. Completely different coverage sorts will embody completely different ranges of safety and premiums.

Protection Choices

Gecko’s complete protection choices present a variety of safety in your automobile. These coverages are designed to handle potential dangers related to possession and use. Protection choices can range in scope and monetary burden, relying on the chosen coverage kind. These insurance policies could be personalized to suit particular wants.

Illustrative Coverage Eventualities

Think about a younger skilled, commuting every day of their sedan. A typical coverage would seemingly cowl harm from collisions and theft. Alternatively, a coverage tailor-made to a classic sports activities automobile fanatic would possibly embody extra coverages for restoration and restore. The premiums and protection ranges will range relying on the coverage kind and particular person circumstances.

Coverage Protection Desk

| Protection Kind | Description | Instance State of affairs | Price/Premium |

|---|---|---|---|

| Collision | Covers harm to your automobile attributable to a collision with one other automobile or object. | Your automobile is rear-ended in site visitors. | Variable, depending on coverage kind and deductible. |

| Complete | Covers harm to your automobile from occasions apart from collisions, comparable to hearth, vandalism, or climate occasions. | Your automobile is broken in a hailstorm. | Variable, depending on coverage kind and deductible. |

| Legal responsibility | Covers the monetary accountability for damages you trigger to different individuals’s property or accidents to others in an accident. | You trigger an accident and harm one other automobile. | Variable, depending on coverage limits. |

| Uninsured/Underinsured Motorist | Protects you in case you are concerned in an accident with a driver who doesn’t have insurance coverage or whose insurance coverage is inadequate to cowl your losses. | You’re hit by a driver with no insurance coverage, inflicting substantial harm to your automobile. | Variable, depending on coverage limits. |

Declare Dealing with

Gecko’s declare course of is designed to be swift and environment friendly. A devoted claims workforce works diligently to evaluate the validity of a declare and expedite the settlement course of. The workforce will consider the harm and supply a good settlement inside the stipulated timeframe. The effectivity of the method is determined by elements such because the readability of the declare documentation and the completeness of the knowledge supplied.

Buyer Service and Help

A tapestry of care, Gecko’s customer support weaves a path of ease and understanding. From the preliminary inquiry to the ultimate decision, every interplay is meticulously crafted to satisfy and exceed expectations. The seamless journey by means of Gecko’s help channels is a testomony to their dedication to shopper satisfaction.Gecko’s customer support channels supply a various vary of choices to make sure accessibility for each shopper.

Whether or not in search of fast help or preferring a extra customized strategy, the choices are plentiful and cater to numerous preferences. The streamlined course of ensures a swift decision, minimizing frustration and maximizing the worth of the shopper expertise.

Buyer Service Channels

Gecko’s dedication to accessibility manifests in a plethora of channels for buyer interplay. This multifaceted strategy ensures purchasers can join in a approach that most accurately fits their wants and preferences. The number of strategies empowers purchasers to navigate their insurance coverage journey with confidence.

- Telephone Help: A direct line to professional advisors, telephone help supplies fast options for urgent issues. Skilled representatives, well-versed in coverage intricacies, supply customized help and tackle advanced conditions promptly.

- On-line Portal: A digital sanctuary for coverage administration, the web portal empowers purchasers to entry their account particulars, observe claims, and submit inquiries 24/7. This self-service choice gives a handy various to conventional strategies.

- E-mail Help: A devoted e mail channel facilitates communication relating to particular coverage particulars or requests. Responses are usually supplied inside a specified timeframe, guaranteeing well timed communication and environment friendly problem-solving.

- Chat Help: Actual-time interplay by means of chat help allows fast decision of easy inquiries. This dynamic strategy permits for fast suggestions and addresses easy points effectively.

Response Time and Decision Course of

Gecko strives to supply immediate and efficient responses to buyer inquiries. The response time for numerous help channels is meticulously tracked and optimized to make sure well timed help. A streamlined decision course of ensures environment friendly dealing with of each buyer interplay.

- Telephone help usually responds inside 1-2 enterprise days for normal inquiries, with advanced points doubtlessly taking as much as 3-5 days for full decision.

- On-line portal inquiries are usually answered inside 24 hours, with most points resolved inside 2-3 enterprise days. The web portal permits for monitoring of declare standing and progress, offering clear and environment friendly updates.

- E-mail help usually responds inside 24-48 hours, with decision instances relying on the complexity of the problem. A devoted e mail thread ensures all correspondence is organized and simply accessible.

- Chat help goals for fast responses and resolutions. The vast majority of easy inquiries are addressed and resolved through the interplay, minimizing wait instances and enhancing the real-time expertise.

Comparability to Different Insurance coverage Suppliers

Gecko’s customer support distinguishes itself by means of its dedication to client-centric options. Whereas different suppliers could prioritize effectivity over personalization, Gecko focuses on a harmonious mix of each. This dedication to care differentiates Gecko’s service from the competitors. A dedication to understanding particular person shopper wants units a brand new customary.

Profitable Buyer Service Interactions

Quite a few constructive experiences illustrate Gecko’s dedication to excellence in customer support. A typical thread woven by means of these interactions is a demonstrable understanding of the shopper’s wants, together with the proactive decision of any challenges encountered.

- A buyer experiencing a declare delay obtained common updates and clear explanations, demonstrating proactive communication and a dedication to transparency.

- One other buyer in search of help with a coverage change obtained customized steerage and help all through your entire course of, highlighting a tailor-made strategy to customer support.

- A 3rd buyer with a posh coverage state of affairs was supplied with a devoted help consultant who patiently defined numerous choices and in the end resolved the problem to the client’s satisfaction, showcasing the flexibility to navigate advanced circumstances.

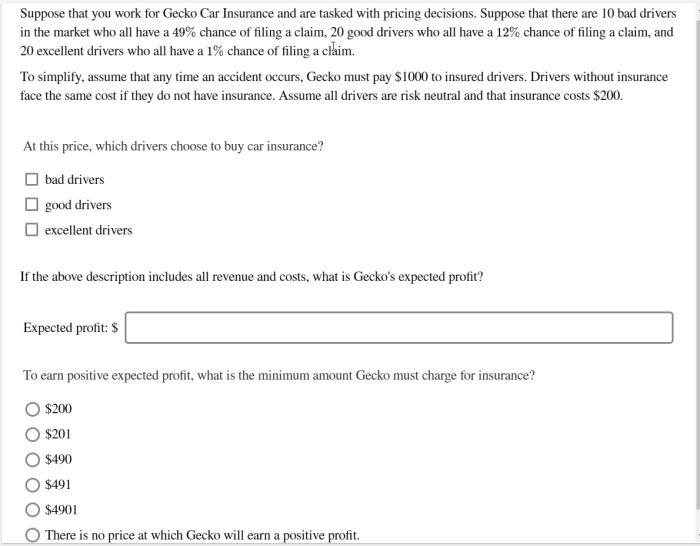

Pricing and Worth Proposition

Gecko’s pricing, a symphony of calculated worth, orchestrates a compelling proposition for discerning drivers. It is a delicate stability, harmonizing elements from threat evaluation to market developments, leading to a tailor-made insurance coverage expertise. The strategy is just not arbitrary; it is a meticulously crafted providing that resonates with the wants of the trendy driver.

Components Influencing Gecko’s Pricing Technique

Gecko’s pricing technique is a classy dance, meticulously choreographed by a constellation of things. These embody, however should not restricted to, the motive force’s historical past, automobile kind, location, and driving habits. Refined algorithms, analyzing a mess of information factors, kind the inspiration of this calculated strategy. The objective is to supply a good and clear premium that displays the precise threat profile of every policyholder.

This technique, like a well-honed instrument, ensures aggressive pricing whereas sustaining monetary stability for the corporate.

Gecko’s Pricing Construction vs. Opponents

Gecko’s pricing construction stands other than its opponents. It differs in its clear and data-driven strategy. Not like some opponents that depend on opaque pricing fashions, Gecko’s pricing is demonstrably tied to the person dangers related to every coverage. This transparency fosters belief and empowers prospects with a transparent understanding of their premiums. The strategy emphasizes tailor-made options, slightly than one-size-fits-all packages.

Worth Proposition of Gecko’s Pricing

Gecko’s pricing gives a singular worth proposition: inexpensive premiums whereas sustaining a strong stage of protection. It is a compelling proposition that targets the trendy driver in search of each monetary accountability and complete safety. By leveraging superior expertise and actuarial science, Gecko goals to ship a premium that aligns with particular person wants, thereby reaching a harmonious stability between value and protection.

Value Tiers and Corresponding Protection Ranges

Gecko gives tiered pricing plans, every reflecting a distinct stage of protection and advantages. The tiers are designed to cater to a wide range of wants and budgets. This strategy is much like a spectrum, with every tier offering a definite and well-defined stage of safety.

| Tier | Premium | Protection Abstract | Extra Advantages |

|---|---|---|---|

| Primary | $500-$1000 | Legal responsibility protection, complete safety towards minor damages. | Accident forgiveness program for minor violations. |

| Normal | $1000-$2000 | Full legal responsibility protection, complete safety towards reasonable damages, and better deductible choices. | Accident forgiveness program for minor violations, roadside help. |

| Premium | $2000-$4000 | Complete protection, high-value safety, and enhanced collision protection. | Accident forgiveness program for minor violations, roadside help, reductions on different companies like rental vehicles. |

| Luxurious | $4000+ | Complete protection, top-tier safety towards in depth damages, and customised protection choices. | Accident forgiveness program for minor violations, roadside help, premium concierge companies, and better declare limits. |

Low cost Packages Supplied by Gecko

Gecko acknowledges and rewards accountable driving habits. To additional improve the worth proposition, Gecko gives numerous low cost applications designed to decrease premiums. These applications, like a constellation of rewards, are supposed to encourage and incentivize protected driving practices.

- Protected Driving Reductions: Encourages protected driving habits by means of usage-based applications and accident-free information.

- Multi-Car Reductions: Supplies reductions for purchasers insuring a number of automobiles beneath one coverage.

- Bundled Providers Reductions: Affords reductions when bundling insurance coverage with different companies like dwelling or renters insurance coverage.

- Pupil Reductions: Supplies reductions to college students who meet particular standards, recognizing the worth of accountable younger drivers.

Claims Course of and Settlement

A tapestry of belief weaves by means of the material of insurance coverage, and Gecko Automotive Insurance coverage meticulously crafts a seamless claims course of. From the preliminary whisper of injury to the ultimate, satisfying decision, each step is designed to be environment friendly and equitable, a testomony to our dedication to our valued prospects.

Declare Submitting Process

The method of submitting a declare with Gecko is easy, like navigating a well-marked path. First, contact us by means of our devoted channels – on-line portal, telephone, or e mail – to provoke the method. A transparent and concise description of the incident, together with any supporting documentation, will expedite the declare evaluation. Thorough documentation is paramount; a meticulous document ensures a swift and correct decision.

Declare Documentation and Submission

Totally documenting the harm is essential for a swift and correct declare settlement. This contains pictures or movies of the harm, copies of any related police stories, witness statements, and restore estimates. The readability and completeness of the documentation immediately influence the pace and accuracy of the settlement. Presenting complete documentation ensures a smoother path to assert decision.

Declare Eventualities and Settlement Course of

Think about a state of affairs the place a fender bender leads to minor harm. The declare course of would possibly contain a fast inspection, approval, and a direct cost to the restore store. Alternatively, a extra vital accident would possibly necessitate an in depth investigation, appraisal, and doubtlessly a substitute automobile. In every occasion, Gecko meticulously adheres to established procedures, guaranteeing equity and transparency all through the settlement course of.

The intricate dance of evaluation, analysis, and cost culminates in a decision that honors each the client’s wants and the insurer’s tasks.

Gecko Declare Course of Levels

| Stage | Description | Paperwork Required | Timeframe |

|---|---|---|---|

| Declare Initiation | Contacting Gecko and offering preliminary particulars of the incident. | Coverage particulars, transient description of the incident. | Inside 24 hours (on-line) or 48 hours (telephone/e mail) |

| Evaluation | Gecko’s analysis of the declare primarily based on supplied data and documentation. | Supporting documentation (photographs, movies, police stories). | 2-5 enterprise days |

| Settlement Approval | Determination on the declare’s approval or denial, together with the phrases of settlement. | Detailed restore estimates, approval of restore store. | 3-7 enterprise days (minor harm); 7-14 enterprise days (main harm) |

| Cost Processing | Finalization of cost to the restore store or direct cost to the client, relying on the declare kind. | Financial institution particulars, restore store data. | 1-3 enterprise days (relying on cost technique). |

Declare Dispute Decision

If a buyer disagrees with the declare settlement, Gecko gives a structured dispute decision course of. This entails a overview of the preliminary evaluation and settlement, with the chance for added documentation and proof. Gecko strives to resolve disputes pretty and effectively, using a impartial strategy to make sure mutual satisfaction. Communication and collaboration are key to navigating any disagreements, guaranteeing a passable final result for all events concerned.

Insurance coverage Business Traits and Improvements

The automobile insurance coverage panorama, a tapestry woven with threads of threat and reward, is continually evolving. New applied sciences and shifting societal norms reshape the trade, demanding agility and innovation from suppliers like Gecko. This transformation, a dance between the established and the rising, presents each challenges and alternatives.The way forward for automobile insurance coverage, a symphony of information and digital options, is taking form.

Gecko, a pioneer on this evolving ecosystem, embraces these developments, guaranteeing continued excellence in offering inexpensive and complete protection.

Latest Developments and Traits

The automobile insurance coverage trade is present process a interval of serious evolution. Telematics, leveraging driver habits knowledge, is changing into more and more prevalent. Utilization-based insurance coverage, customized primarily based on driving habits, is remodeling the way in which premiums are calculated. Moreover, the rise of autonomous automobiles and linked automobile expertise presents each thrilling potentialities and complex challenges for threat evaluation and protection. The trade is adjusting to those improvements by incorporating data-driven fashions to refine pricing and improve claims administration.

Revolutionary Approaches by Gecko, Suppose that you simply work for gecko automobile insurance coverage

Gecko, a nimble innovator, actively embraces cutting-edge applied sciences to stay aggressive. Its dedication to user-friendly digital platforms and intuitive cellular apps permits prospects seamless entry to their insurance policies, claims, and help. Harnessing the ability of predictive analytics, Gecko tailors protection to particular person wants, optimizing worth and cost-effectiveness. By strategic partnerships with expertise suppliers, Gecko expands its technological capabilities and enhances its buyer expertise.

Gecko’s Response to Rising Challenges

The rise of autonomous automobiles necessitates a reevaluation of legal responsibility and accountability. Gecko anticipates these developments by investing in analysis and growth to adapt its protection fashions to embody the distinctive dangers introduced by self-driving vehicles. The evolving nature of cyber dangers and their potential influence on automobile operations is one other necessary side of consideration. Gecko proactively addresses these issues by staying knowledgeable concerning the newest trade requirements and technological developments.

The corporate’s dedication to adaptation and resilience ensures its continued relevance within the ever-changing insurance coverage market.

Gecko’s Use of Know-how and Digital Instruments

Gecko leverages a strong technological infrastructure to supply prospects with a streamlined expertise. The corporate’s cellular app facilitates coverage administration, declare reporting, and buyer help, making a extra handy and accessible service. Information analytics instruments enable Gecko to refine pricing fashions, establish potential dangers, and optimize its total operations. These instruments present a big benefit by providing predictive capabilities and permitting Gecko to stay proactive in its strategy.

Impression of New Applied sciences on the Insurance coverage Sector

New applied sciences, comparable to synthetic intelligence and machine studying, are reshaping the insurance coverage sector. AI algorithms can course of huge quantities of information, enabling insurers to evaluate threat extra precisely and personalize pricing. The usage of machine studying permits for predictive modeling, figuring out developments and patterns in claims knowledge to proactively tackle potential points. These applied sciences have the potential to dramatically improve the effectivity and effectiveness of insurance coverage operations, in the end benefiting each prospects and suppliers.

Security Options and Driving Habits

Gecko Automotive Insurance coverage understands that accountable driving is a cornerstone of highway security. We imagine in rewarding drivers who prioritize security, each of their automobiles and their habits. This dedication displays our dedication to fostering a safer driving setting for everybody on the roads.Our strategy to incentivizing protected driving habits is multifaceted, encompassing a spectrum of applications and initiatives.

We acknowledge that accountable driving is just not merely a matter of adhering to guidelines however a proactive selection for a safer journey.

Gecko’s Incentives for Protected Driving

Gecko fosters a tradition of protected driving by means of numerous initiatives. These vary from providing reductions for automobiles geared up with superior security options to selling protected driving practices by means of instructional campaigns. Our objective is to empower drivers to make aware selections that contribute to a safer highway setting.

- Security Function Reductions: Autos geared up with superior driver-assistance methods (ADAS) comparable to computerized emergency braking (AEB), lane departure warning, and adaptive cruise management, reveal a dedication to security. Gecko rewards drivers for this proactive strategy by providing reductions on their premiums.

- Protected Driving Packages: Gecko companions with native driving colleges and organizations to conduct workshops and academic periods on protected driving methods. These applications equip drivers with sensible abilities and insights for avoiding accidents and bettering their driving habits.

- Rewarding Accountable Driving: Drivers who keep a constantly protected driving document by means of utilization of security options and applicable driving habits earn reductions on their premiums. This reinforces constructive driving habits and motivates drivers to undertake a extra proactive strategy to security.

Function of Security Options in Pricing

Security options play a big function in figuring out automobile insurance coverage premiums. Autos with superior security options are sometimes perceived as much less liable to accidents, resulting in decrease premiums for his or her house owners. This isn’t solely primarily based on empirical proof but additionally on the truth that these options usually mitigate the severity of collisions.

“Autos geared up with superior security options, comparable to airbags, anti-lock brakes, and digital stability management, demonstrably scale back the chance and severity of accidents.”

Correlation Between Protected Driving Scores and Premiums

A direct correlation exists between a driver’s security rating and their insurance coverage premium. The next security rating usually interprets to a decrease premium, reflecting the motive force’s dedication to protected driving practices.

| Security Rating | Low cost Proportion | Instance Driving Habits | Security Suggestions |

|---|---|---|---|

| Wonderful (90-100) | 15-20% | Adheres to hurry limits, maintains protected following distances, makes use of security options, and avoids aggressive maneuvers. | Repeatedly overview your automobile’s security options and keep them. |

| Good (80-89) | 10-15% | Usually follows site visitors guidelines, retains a protected distance from different automobiles, and makes use of security options as wanted. | Take part in protected driving workshops or on-line programs. |

| Honest (70-79) | 5-10% | Occasional lapses in protected driving practices, however usually follows site visitors guidelines. | Follow defensive driving methods. |

| Poor (Beneath 70) | No low cost or potential surcharge | Frequent violations of site visitors legal guidelines, aggressive driving, and unsafe maneuvers. | Search skilled assist for driver enchancment. |

Components Influencing Premiums Based mostly on Driving Habits

Insurance coverage premiums are influenced by numerous elements associated to driving habits. These embody the motive force’s age, driving historical past, the automobile’s make and mannequin, and the motive force’s location. A driver’s historical past of accidents or site visitors violations considerably impacts their premium charges.

- Driving Historical past: A clear driving document, devoid of accidents or site visitors violations, usually results in decrease premiums. Conversely, a historical past of accidents or site visitors violations could end in larger premiums.

- Car Kind: Sure automobile fashions are inherently safer than others, and these security options and design are mirrored in insurance coverage premiums.

- Location: Areas with larger accident charges usually have larger insurance coverage premiums as a result of elevated threat of collisions.

- Driving Habits: Aggressive driving, rushing, or reckless maneuvers will end in larger insurance coverage premiums. Conversely, accountable driving practices like adhering to hurry limits and sustaining protected following distances end in decrease premiums.

Wrap-Up

In conclusion, suppose that you simply work for Gecko Automotive Insurance coverage, understanding their operational specifics is vital for efficient engagement with their clientele. This detailed exploration supplies insights into their insurance policies, customer support, pricing methods, and claims processes. By understanding their aggressive place and dedication to innovation, one can higher admire Gecko’s place within the insurance coverage market. This overview empowers knowledgeable decision-making, whether or not as a potential buyer, a competitor, or an trade observer.

Solutions to Frequent Questions

What’s Gecko Automotive Insurance coverage’s distinctive promoting proposition (USP)?

Gecko emphasizes customer-centric service and aggressive pricing. Their strategy combines modern applied sciences with a dedication to clear communication.

How does Gecko deal with claims disputes?

Gecko employs a multi-step course of, involving mediation and negotiation, aiming for a good and environment friendly decision for all events concerned.

What are the standard response instances for buyer inquiries?

Gecko strives for well timed responses. Response instances rely on the character of the inquiry and present workload.

Does Gecko supply reductions for protected driving?

Sure, Gecko incentivizes protected driving with reductions for drivers with a clear driving document and adherence to protected driving practices.