Stolen automobile insurance coverage payout calculator helps you perceive how a lot your insurance coverage will cowl in case your car is stolen. This information particulars the components influencing payouts, from car worth and protection sort to the declare course of and potential pitfalls. It additionally offers a comparability of various insurance coverage suppliers and suggestions for maximizing your payout. Navigating the complexities of a stolen automobile declare might be difficult, however this complete useful resource goals to simplify the method.

Understanding the intricacies of a stolen car declare is essential. This calculator and information will present a transparent roadmap that can assist you navigate the often-confusing strategy of receiving compensation. The method includes a number of steps, from preliminary reporting to remaining settlement, every with particular necessities and potential hurdles. We’ll cowl the assorted components that have an effect on the payout quantity, serving to you anticipate and put together for the potential end result.

Introduction to Stolen Automobile Insurance coverage Payouts

Getting your automobile again after a theft is a demanding expertise. Fortunately, stolen automobile insurance coverage payouts will help you get again in your ft. These payouts are designed to compensate for the lack of your car and generally related bills. Understanding how these payouts work is essential to navigating the method easily.Stolen automobile insurance coverage payouts are a monetary reimbursement out of your insurance coverage firm after your automobile is stolen.

The payout quantity is determined by the precise protection choices you’ve bought and the circumstances of the theft. The method sometimes includes submitting a declare, offering documentation, and ready for the insurance coverage firm to evaluate the declare and approve the payout.

Stolen Automobile Insurance coverage Declare Course of

Submitting a stolen automobile declare sometimes includes these steps:

- Report the Theft to the Police: That is essential. It offers official documentation of the theft, which is important on your insurance coverage declare.

- Contact Your Insurance coverage Firm Instantly: Inform them concerning the theft and comply with their directions for submitting a declare. They will seemingly information you on the mandatory documentation.

- Collect Required Documentation: This will embody your insurance coverage coverage, police report, car registration, and another supporting paperwork requested by the insurance coverage firm.

- Full the Declare Type: Rigorously fill out the insurance coverage declare type, offering correct details about the theft and your car.

- Anticipate the Insurance coverage Firm’s Evaluation: The insurance coverage firm will examine the declare and decide the payout quantity primarily based in your protection.

Forms of Protection Concerned in a Stolen Automobile Declare

Various kinds of automobile insurance coverage cowl completely different features of a stolen automobile declare. Understanding these coverages will assist you to decide what you are eligible for.

| Protection Kind | Description | Typical Payout Situations |

|---|---|---|

| Complete Protection | Covers damages to your car from perils aside from collision, akin to theft, vandalism, or climate occasions. | In case your automobile was stolen, complete protection will seemingly cowl the total alternative price of your car, probably as much as the coverage’s limits. |

| Collision Protection | Covers damages to your car ensuing from a collision with one other object or car, together with theft-related damages if the thief precipitated injury to the automobile throughout the theft. | Collision protection could also be concerned if the automobile was broken earlier than or throughout the theft. The payout will depend upon the extent of the injury. |

| Uninsured/Underinsured Motorist Protection | Protects you if the one who stole the automobile has no or inadequate insurance coverage to cowl your losses. | This protection pays on your car’s worth if the accountable social gathering is not adequately insured. |

| GAP Insurance coverage | A supplemental coverage that covers the distinction between your car’s mortgage worth and its precise money worth (ACV) in case of a complete loss, akin to a stolen car. | In case your automobile is stolen and the insurance coverage payout would not totally cowl the mortgage quantity, GAP insurance coverage will help bridge the hole. |

Components Influencing the Payout Quantity

A number of components affect the ultimate payout quantity:

- Coverage Limits: The utmost quantity your insurance coverage coverage pays for a coated loss. This can be a essential issue, as payouts can not exceed these limits.

- Automobile Worth: The present market worth of your car on the time of the theft. Value determinations and up to date gross sales of comparable automobiles are used to find out the honest market worth.

- Deductibles: A pre-determined quantity you are answerable for paying earlier than your insurance coverage firm begins paying. This quantity reduces the payout.

- Extra Bills: Some insurance policies might cowl extra bills associated to the theft, like towing or non permanent rental charges.

Components Affecting Payout Quantities

Getting your stolen automobile insurance coverage payout can really feel like navigating a maze. Understanding the components influencing the quantity you obtain is essential. This part will demystify the method, explaining how numerous parts affect your remaining payout. From the worth of your car to the nuances of your coverage, we’ll break down the whole lot it’s good to know.

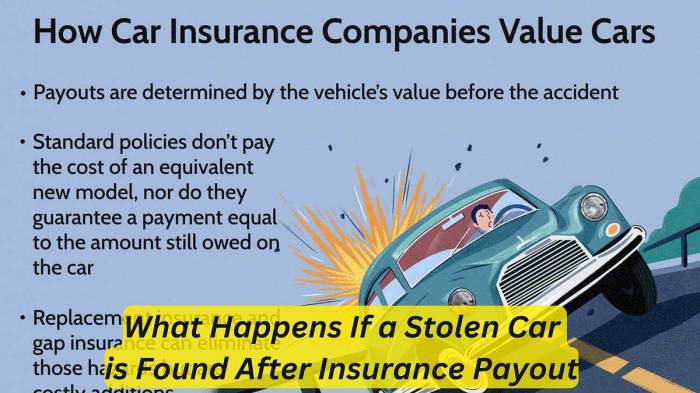

Automobile Worth and Depreciation

Essentially the most vital issue is the automobile’s worth on the time of theft. Insurers sometimes base payouts on the car’s honest market worth, which is influenced by make, mannequin, 12 months, situation, and mileage. Depreciation performs a key function right here. A more recent, higher-value automobile depreciates quicker than an older mannequin. This implies a payout for a stolen newer automobile could be decrease than the unique buy worth, particularly if it has been just a few years since buy.

This can be a essential aspect to think about when calculating your anticipated payout.

Deductible and Protection Kind

Your coverage’s deductible and protection sort considerably affect the payout quantity. The deductible is the quantity you pay out-of-pocket earlier than the insurance coverage firm steps in. For instance, a $500 deductible means you will pay $500, and the insurance coverage firm will cowl the remainder. Totally different protection varieties, akin to complete or collision, additionally have an effect on the payout. Complete protection normally covers theft, whereas collision sometimes would not.

The specifics of your coverage will decide the extent of the protection.

Police Report and Proof of Theft

A proper police report is usually obligatory for insurance coverage claims. The report particulars the circumstances surrounding the theft, offering essential proof on your declare. Supporting proof, akin to images of the injury or any safety footage, can bolster your declare and probably affect the payout. The accuracy and completeness of the police report, together with any corroborating proof, instantly affect the insurance coverage firm’s analysis of your declare.

Lowered or Denied Payouts

Whereas insurance coverage firms intention to pretty compensate policyholders, a number of conditions can result in decreased or denied payouts. Failure to file a well timed declare, offering inaccurate info, or having a historical past of fraudulent claims can set off a evaluate or denial. Moreover, if the theft occurred as a result of your negligence, akin to leaving the automobile unlocked in a high-crime space, your payout could be decreased or denied.

That is usually as a result of components exterior the standard circumstances coated by commonplace insurance coverage.

Impression of Components on Payout

| Issue | Excessive Impression | Medium Impression | Low Impression |

|---|---|---|---|

| Automobile Worth | Increased automobile worth, larger payout | Common automobile worth, common payout | Decrease automobile worth, decrease payout |

| Deductible | Increased deductible, decrease payout for the insurance coverage firm | Common deductible, common payout | Decrease deductible, larger payout for the insurance coverage firm |

| Protection Kind | Complete protection, larger payout | Collision protection, decrease payout for theft | Restricted protection, decrease payout |

| Police Report/Proof | Full, detailed report with proof, larger payout | Incomplete report, barely decrease payout | No report/proof, payout denied or considerably decreased |

Understanding Coverage Phrases and Situations: Stolen Automobile Insurance coverage Payout Calculator

Navigating the fantastic print of your automobile insurance coverage coverage can really feel like deciphering a secret code. However understanding your coverage’s phrases and situations is essential, particularly when a declare like a stolen automobile comes into play. Figuring out the specifics of your protection helps guarantee a smoother and extra predictable payout course of. This part dives deep into the language of your coverage, revealing the hidden treasures and potential pitfalls.

Significance of Reviewing Coverage Phrases and Situations

Your insurance coverage coverage is a legally binding contract. Totally reviewing it earlier than a declare is important. It Artikels precisely what your insurer covers and, equally importantly, what they do not. This proactive strategy prevents misunderstandings and potential disputes down the street.

Key Clauses Associated to Automobile Theft Protection

Particular clauses inside your coverage dictate the extent of your theft protection. Search for clauses explicitly addressing the next: the definition of “theft,” the quantity of protection supplied, and any necessities for reporting the theft to the authorities. Totally different insurers use barely various language, so a cautious learn is critical.

Exclusions and Limitations of Protection, Stolen automobile insurance coverage payout calculator

Understanding what’s excluded from protection is simply as vital as understanding what’s included. Frequent exclusions embody acts of vandalism, or if the car was left in a high-risk space, or if the car wasn’t correctly secured. Limitations on protection would possibly contain deductibles, most payout quantities, or timeframes for submitting claims. These particulars can considerably affect the ultimate payout quantity.

Decoding Complicated Coverage Language

Insurance coverage coverage language might be dense and complex. To decipher it successfully, break down the clauses into smaller, manageable elements. Search for key phrases and phrases and use on-line sources to search out definitions of unfamiliar phrases. Seek the advice of with a monetary advisor or insurance coverage skilled if wanted, particularly for notably advanced clauses. Use a highlighter to mark vital factors and use a pocket book to notice any questions you’ve.

Abstract of Key Coverage Phrases

| Coverage Time period | Relevance to Stolen Automobile Claims |

|---|---|

| Definition of “Theft” | This clause defines the circumstances beneath which your insurer considers the automobile to have been stolen. Figuring out the precise situations ensures your declare aligns with the coverage. |

| Protection Quantity | This determines the utmost quantity the insurer pays out. Figuring out the precise limits prevents disappointment. |

| Reporting Necessities | Understanding the required steps to report the theft (e.g., contacting the police, offering documentation) is important. |

| Exclusions (e.g., vandalism, improper safety) | These clauses Artikel conditions the place the insurer won’t pay out, akin to if the car was broken as a result of vandalism. |

| Deductible | The deductible is the quantity you will pay out-of-pocket earlier than the insurance coverage firm covers the loss. |

| Time Limits | This particulars the timeframe for reporting the declare. Lacking these deadlines might invalidate your declare. |

Comparability of Totally different Insurance coverage Suppliers

Insurance coverage firms aren’t all created equal, particularly in terms of stolen automobile payouts. Similar to evaluating completely different eating places, it’s good to look past the menu (the coverage particulars) to see what actually units them aside. This comparability will assist you to perceive the important thing variations in payout insurance policies, declare processes, and customer support to make an knowledgeable choice.Totally different insurance coverage suppliers have various approaches to dealing with stolen automobile claims.

This usually leads to disparities in payout quantities and declare decision instances. Some would possibly provide larger payouts however with extra stringent declare procedures. Understanding these nuances is essential for getting the very best end result when submitting a declare.

Payout Insurance policies Throughout Suppliers

Insurance coverage firms tailor their payout insurance policies primarily based on numerous components, together with the kind of protection, the worth of the car, and the precise circumstances surrounding the theft. This usually results in substantial variations within the quantities they’re keen to pay out. Some firms would possibly provide the next payout if the theft occurred in a high-crime space, whereas others might have a decrease payout cap whatever the location.

| Insurance coverage Supplier | Protection Quantity (Instance) | Declare Course of Complexity | Buyer Service Ranking (Common) |

|---|---|---|---|

| Acme Insurance coverage | $15,000 for a 2018 Sedan | Reasonable (3-5 enterprise days to approve) | 4.2 out of 5 |

| Dependable Insurance coverage | $18,000 for a 2020 SUV | Excessive (7-10 enterprise days to approve) | 4.5 out of 5 |

| Safe Protect Insurance coverage | $12,000 for a 2022 Hatchback | Low (2-4 enterprise days to approve) | 3.8 out of 5 |

| United Insurance coverage | $16,500 for a 2021 Truck | Reasonable (4-6 enterprise days to approve) | 4.1 out of 5 |

This desk offers a fundamental comparability. Precise payout quantities can fluctuate considerably relying on particular coverage particulars and the small print of the declare. You’ll want to rigorously evaluate your coverage and examine completely different suppliers primarily based in your particular wants. The common customer support scores are primarily based on aggregated evaluations and must be used as a tenet.

Declare Processes and Timelines

Declare processes fluctuate enormously between insurance coverage firms. Some firms have streamlined on-line portals for fast declare submissions and approvals, whereas others require extra paperwork and in-person interactions. The time it takes to obtain a payout can even differ significantly. For instance, an organization with a fame for fast declare processing might need a median declare settlement time of 2-4 weeks, whereas one other firm would possibly take 6-8 weeks.

Buyer Service High quality

Customer support is a crucial side of the insurance coverage expertise, notably throughout a declare course of. Corporations with sturdy customer support reputations are extra seemingly to offer well timed help and help. That is vital when coping with advanced claims or when dealing with disputes. Think about contacting customer support representatives instantly and studying on-line evaluations to evaluate the standard of service earlier than selecting an insurance coverage firm.

Customer support high quality is a subjective measure, and particular person experiences might fluctuate.

Declare Course of and Documentation

Navigating the method of submitting a stolen automobile insurance coverage declare can really feel daunting, however understanding the steps concerned and the mandatory documentation could make the entire expertise smoother. This part breaks down the declare course of, from preliminary report back to remaining payout, that can assist you really feel extra in management.

Submitting a Stolen Automobile Insurance coverage Declare

The declare course of usually begins with reporting the theft to the police. This report serves as essential documentation, offering a proper file of the incident. Afterward, you could notify your insurance coverage firm as quickly as doable. This immediate notification ensures that the declare is initiated promptly and the insurance coverage firm can start the investigation.

Needed Documentation

A complete declare requires numerous paperwork. The core paperwork normally embody a police report, proof of possession (just like the car registration), and any related supporting proof. Pictures of the broken car (if any) and another proof associated to the theft, akin to safety footage or witness statements, can considerably strengthen your declare. Insurance coverage firms sometimes require particular varieties to be accomplished and submitted as a part of the declare course of.

Declare Timeline

The timeframe for receiving a payout varies primarily based on the insurance coverage firm’s procedures and the complexity of the declare. Some firms have a streamlined course of, whereas others might take extra time. Components like the supply of supporting paperwork and the necessity for additional investigation can have an effect on the timeline. An estimated timeframe for a easy declare could be 4-6 weeks, whereas extra advanced instances might take longer.

As an example, a declare involving intensive investigation or disputed valuation would possibly stretch to 8-12 weeks.

Resolving Disputes

Disputes relating to payout quantities are doable, notably if the insurance coverage firm’s evaluation differs out of your expectations. In the event you disagree with the supplied payout, contacting the insurance coverage firm’s claims division to elucidate your considerations and supporting proof is essential. Mediation or arbitration could also be out there as different dispute decision choices if direct negotiations are unsuccessful. A transparent and detailed communication file is important all through the dispute decision course of.

Declare Course of Steps

- Report the theft to the police and procure a police report.

- Notify your insurance coverage firm instantly and supply the mandatory particulars, together with the car’s VIN and coverage quantity.

- Collect all required documentation, together with the police report, car registration, and any supporting proof (e.g., safety footage, witness statements).

- Full the insurance coverage declare type precisely and submit it together with all supporting paperwork.

- The insurance coverage firm will examine the declare, which can contain contacting the police or conducting a valuation.

- As soon as the investigation is full, the insurance coverage firm will assess the declare and challenge a payout primarily based in your coverage phrases.

- If there is a dispute concerning the payout quantity, contact the claims division and supply supporting proof.

- If the dispute stays unresolved, take into account mediation or arbitration.

Declare Course of Desk

| Step | Description |

|---|---|

| 1 | Report Theft to Police |

| 2 | Notify Insurance coverage Firm |

| 3 | Collect Documentation |

| 4 | Full Declare Type |

| 5 | Insurance coverage Firm Investigation |

| 6 | Payout Evaluation |

| 7 | Dispute Decision (if wanted) |

Suggestions for Maximizing Payouts

Getting the utmost payout out of your stolen automobile insurance coverage declare is not nearly luck; it is about sensible preparation and a well-executed technique. Following finest practices all through the declare course of considerably will increase your possibilities of a beneficial end result. This part Artikels key methods for maximizing your payout, from submitting the declare accurately to navigating potential roadblocks.

Submitting a Declare Effectively

A easy declare course of begins with meticulous documentation and a transparent understanding of your coverage’s necessities. Thorough record-keeping ensures you’ve all crucial info available when the insurer wants it. This contains not simply the police report, but additionally any receipts, images, or movies associated to the theft and your car’s situation. The quicker you file a declare, the earlier you’ll be able to start the restoration course of.

- Submit an entire declare bundle: Guarantee all required paperwork, just like the police report, proof of possession, and any supporting proof (e.g., restore estimates), are included in your preliminary declare submission. A whole bundle streamlines the declare course of.

- Talk promptly and clearly: Preserve open communication along with your insurance coverage supplier all through the method. This includes responding to their inquiries promptly and precisely. Reply to all correspondence, emails, and cellphone calls promptly.

- Be life like concerning the declare course of: Perceive that claims take time to course of. Be ready for potential delays and preserve constant follow-up.

Guaranteeing Correct and Detailed Data

Offering exact and correct particulars about your stolen car is essential. This contains the make, mannequin, 12 months, VIN (Automobile Identification Quantity), and any distinguishing options. The extra correct the data, the quicker the declare course of will likely be and the extra seemingly it’s that the insurance coverage firm can precisely assess the car’s worth.

- Preserve detailed data: Preserve copies of all correspondence, restore estimates, and another related paperwork. A well-organized record-keeping system will assist you within the declare course of and supply proof of your declare.

- Doc the whole lot: Take images or movies of the car’s situation earlier than the theft, if doable. When you’ve got any pre-theft injury data, embody them within the declare documentation. This documentation is essential in establishing the car’s pre-theft worth.

Getting ready for Potential Delays or Disputes

Insurance coverage claims, whereas sometimes easy, can sometimes encounter delays or disputes. Understanding potential roadblocks and getting ready for them is essential. For instance, discrepancies within the reported car particulars or a contested valuation might result in a delay. Figuring out your rights and being ready to current additional proof will help mitigate these potential points.

- Overview your coverage: Totally perceive your coverage’s phrases and situations, particularly relating to the declare course of and payout limits. This ensures you are conscious of the potential roadblocks earlier than they happen.

- Search authorized counsel if crucial: In the event you encounter a dispute or have considerations concerning the declare’s dealing with, take into account consulting with a authorized skilled. This will help you perceive your rights and navigate the method successfully.

Following Up on Declare Standing

Frequently checking on the declare standing ensures you are knowledgeable about its progress. This proactive strategy helps you perceive the declare’s standing and facilitates communication with the insurer.

- Schedule common check-ins: Contact your insurance coverage supplier periodically to inquire concerning the declare’s standing. This proactive strategy retains you up to date and ensures you are on prime of the declare course of.

- Preserve detailed communication data: Doc all communication with the insurance coverage firm, together with dates, instances, and the precise info mentioned. This record-keeping is essential if it’s good to reference earlier conversations.

Avoiding Frequent Errors

Submitting a stolen automobile insurance coverage declare can really feel like navigating a maze. Figuring out the frequent pitfalls can prevent a headache and guarantee a smoother, extra environment friendly course of. Understanding these potential errors is essential for getting the utmost payout you deserve.

Accuracy and Completeness in Documentation

Correct and full documentation is paramount for a profitable declare. Errors, omissions, or inconsistencies can delay and even deny your declare. Consider it like a puzzle; every bit (doc) wants to suit completely to finish the image. If one piece is lacking or incorrect, your complete image is affected.

- Incorrectly Reporting the Theft: Offering inaccurate particulars concerning the theft, just like the date or time, can severely affect the declare’s validity. This might result in your insurance coverage firm questioning the legitimacy of the incident.

- Lacking or Incomplete Documentation: Do not underestimate the facility of paperwork! Ensure you have all crucial paperwork, together with police experiences, witness statements, and car registration. Any lacking piece of the puzzle can hinder the declare course of.

- Incorrectly Describing the Automobile: A exact description of the stolen car, together with its make, mannequin, 12 months, colour, and any distinctive options, is important. A minor discrepancy can result in the declare being rejected.

Penalties of Declare Errors

The implications of creating errors throughout the declare course of might be vital. It might imply a delay in receiving your payout, a denial of the declare altogether, or perhaps a lower within the payout quantity. It is like making an attempt to construct a home on shaky floor; the inspiration must be stable to make sure a profitable end result.

- Delayed Payouts: Errors can result in delays in processing your declare. This could trigger monetary pressure if you happen to want the funds instantly.

- Declare Denial: Insurance coverage firms are legally obligated to uphold their coverage phrases and situations. If the declare is incomplete or inaccurate, the insurance coverage firm would possibly deny it, leaving you with out the compensation you deserve.

- Lowered Payouts: In some instances, inaccuracies would possibly result in a discount within the payout quantity. That is notably true if the inaccuracies relate to the worth of the car or the protection particulars.

Methods to Keep away from Declare Errors

Proactive measures will help you keep away from these pitfalls. Preparation is essential to a easy declare course of. Deal with every step like a puzzle piece; guarantee every bit is appropriate.

- Thorough Documentation: Instantly after the theft, collect all related paperwork, together with police experiences, witness statements, and car registration. Preserve copies of the whole lot. This will likely be invaluable throughout the declare course of.

- Correct Reporting: Present correct and detailed details about the theft to the insurance coverage firm and the police. If unsure, search clarification from the insurance coverage firm.

- Overview Coverage Phrases and Situations: Rigorously evaluate your insurance coverage coverage to know the precise necessities for a stolen car declare. Understanding the phrases is like understanding the principles of the sport.

Instance of a Frequent Mistake and its Impression

Think about a driver reporting their car stolen on Monday however offering the date as Saturday. The insurance coverage firm would possibly query the veracity of the declare, resulting in a delay or denial. This straightforward error might have a major affect on the declare’s end result.

Illustrative Examples of Payouts

Unveiling the intricacies of stolen automobile insurance coverage payouts might be daunting. These examples will illuminate how numerous components converge to find out the ultimate quantity, making the method much less mysterious and extra comprehensible.Understanding the precise circumstances of every case is essential for comprehending the payout calculation. Every situation illustrates how coverage particulars, car situation, and injury affect the settlement.

State of affairs 1: Whole Loss with Complete Protection

A policyholder’s prized classic sports activities automobile, valued at $50,000, was stolen and declared a complete loss. The coverage included complete protection. The insurer’s appraisal decided the automobile’s precise money worth (ACV) on the time of theft was $45,000. This situation displays the insurer’s duty to pay the ACV, quite than the market worth.

Calculation: The insurer pays the ACV of $45,000 to the policyholder, much less any relevant deductibles.

| Issue | Impression on Payout |

|---|---|

| Automobile Worth | A better car worth leads to the next payout (as much as the ACV). |

| Complete Protection | Covers losses past collision, together with theft. |

| Deductible | Reduces the payout by the deductible quantity. |

State of affairs 2: Partial Harm with Collision Protection

A policyholder’s fashionable SUV, value $35,000, was concerned in an accident the place it was stolen. The car sustained vital injury, together with dents and scratches. The insurer’s restore estimate was $12,000. The coverage included collision protection.

Calculation: The insurer pays the restore price of $12,000, much less the deductible. This payout assumes the car might be repaired. If deemed a complete loss, the ACV will likely be paid as an alternative.

| Issue | Impression on Payout |

|---|---|

| Restore Prices | Restore prices instantly affect the payout quantity. |

| Collision Protection | Covers injury from collisions, even when the automobile is stolen. |

| Deductible | Reduces the payout by the deductible quantity. |

State of affairs 3: Stolen Elements with Legal responsibility Protection

A policyholder’s truck, insured beneath legal responsibility protection, had essential elements stolen. The elements, important for the car’s operation, have been value $5,000. The coverage solely covers damages or losses incurred by the insured car whether it is broken or concerned in an accident. The theft of the elements would not fall beneath legal responsibility protection.

Calculation: On this case, there isn’t a payout as a result of legal responsibility protection doesn’t cowl the theft of elements. The policyholder would possibly want to hunt extra insurance coverage or discover different avenues to recuperate the price of the stolen elements.

| Issue | Impression on Payout |

|---|---|

| Protection Kind | Legal responsibility protection solely covers damages to others; it doesn’t cowl the insured car. |

| Stolen Elements | The lack of elements, if circuitously attributable to a collision or accident, won’t be coated. |

Assets for Additional Data

Want greater than only a calculator? Figuring out the place to search out reliable details about stolen automobile insurance coverage payouts is essential. This part factors you in the direction of respected sources that can assist you perceive your rights and choices higher.Looking for professional recommendation is usually the perfect plan of action when coping with advanced insurance coverage claims. Insurance coverage professionals can present tailor-made steering primarily based in your particular state of affairs and coverage.

Respected Insurance coverage Organizations

Insurance coverage firms are a key useful resource for understanding their very own insurance policies. Their web sites normally have detailed details about protection, declare procedures, and regularly requested questions (FAQs). Many provide devoted customer support channels for coverage clarification and declare help. Understanding the language utilized in insurance coverage insurance policies is important.

- Main insurance coverage suppliers usually have devoted sections on their web sites that designate their stolen car protection insurance policies intimately.

- Their FAQs can present fast solutions to frequent questions and considerations.

- Accessing these sources empowers you to know your particular coverage particulars and the way the claims course of operates.

Governmental Companies and Client Safety

Authorities companies usually present invaluable sources and steering for shoppers coping with insurance coverage points. These companies might be notably useful in instances of disputes or suspected unfair practices. Their info is often primarily based on broader authorized and shopper safety frameworks.

- Client safety companies provide useful info on navigating insurance coverage claims, rights, and procedures.

- State insurance coverage departments is usually a invaluable useful resource for particular state laws and steering.

- These companies can help you in understanding your rights as a shopper when coping with insurance coverage firms.

Authorized Professionals and Insurance coverage Advisors

In the event you’re dealing with a posh declare or dispute, looking for authorized recommendation is usually advisable. A lawyer specializing in insurance coverage regulation can present customized steering in your state of affairs, assess the deserves of your declare, and advocate on your pursuits. Insurance coverage advisors will help analyze insurance policies and information you thru the claims course of, providing a unique perspective from an insurance coverage firm’s viewpoint.

- Consultations with authorized professionals specializing in insurance coverage regulation are essential for navigating advanced claims or disputes successfully.

- Impartial insurance coverage advisors can present an goal evaluation of your coverage and assist in navigating the declare course of.

- Authorized professionals will help you perceive your rights and guarantee your declare is dealt with pretty, defending your pursuits.

On-line Boards and Communities

On-line boards and communities devoted to automobile insurance coverage is usually a invaluable supply of data and help. These communities will let you join with different policyholders who’ve confronted comparable conditions and study from their experiences. Nevertheless, it is vital to confirm the accuracy and reliability of data present in these boards.

- On-line boards provide a platform for sharing experiences and gaining insights from others who’ve navigated comparable insurance coverage conditions.

- Be cautious of anecdotal proof and at all times cross-reference info with official sources.

- Help teams is usually a invaluable useful resource for understanding the challenges and options concerned in coping with insurance coverage claims.

Ending Remarks

In conclusion, acquiring a good payout for a stolen car requires cautious consideration of things like car worth, protection sort, and declare procedures. This information provides a complete overview of the method, from preliminary declare submitting to potential disputes. By understanding your coverage phrases, evaluating insurance coverage suppliers, and avoiding frequent errors, you’ll be able to maximize your possibilities of a swift and passable payout.

Bear in mind, looking for skilled recommendation when crucial can considerably enhance your end result.

FAQ Information

What occurs if the police do not discover my stolen automobile?

If the police are unable to find your stolen car, your insurance coverage declare course of should still proceed, relying in your coverage and the proof you present. You will must doc all efforts to recuperate the car, akin to submitting a police report, contacting authorities, and another actions taken to assist within the restoration course of.

How lengthy does it sometimes take to obtain a payout?

The timeframe for receiving a payout can fluctuate considerably relying in your insurance coverage supplier, the complexity of the declare, and any crucial investigations. Some suppliers have faster processing instances, whereas others might take longer. Your insurance coverage coverage ought to specify the standard timeframe.

Can I get a payout if the stolen automobile was not totally paid off?

If the stolen car was not totally paid off, the payout will sometimes be primarily based on the quantity you owe on the mortgage, plus any extra bills, akin to mortgage curiosity or penalties. You could want to offer documentation from the lender to show your possession curiosity.

What if I haven’t got all of the required paperwork?

Contact your insurance coverage supplier instantly to debate the lacking paperwork and work in the direction of an answer. They can help in buying the lacking info or might provide different strategies for offering the required documentation.