Is insurance coverage cheaper on a brand new automobile? Nicely, it is a query that pops up rather a lot, and the reply is not at all times simple. It is dependent upon numerous issues, like the kind of automobile, your driving document, and even the place you reside. Let’s dive into the small print and discover out if that shiny new journey will prevent some rupiah in your insurance coverage premiums.

This complete information explores the elements that affect insurance coverage prices for brand new vehicles, evaluating them to used vehicles. We’ll additionally uncover potential reductions, protection choices, and learn how to examine insurance coverage suppliers to get the perfect deal. So, buckle up and let’s get into the nitty-gritty of recent automobile insurance coverage!

Components Affecting Insurance coverage Prices

Automobile insurance coverage premiums aren’t a one-size-fits-all determine. Quite a few elements play a big function in figuring out the worth you pay. Understanding these components may also help you make knowledgeable choices to probably decrease your prices. From the kind of automobile you drive to your driving document, location, and private particulars, every facet contributes to the ultimate insurance coverage quote.Insurance coverage corporations assess danger to calculate premiums.

A better perceived danger ends in a better premium. This danger evaluation considers a variety of variables, together with elements associated to the automobile itself, the driving force, and the placement the place the automobile is primarily used. The last word aim is to stability the prices of claims with the income generated from premiums.

Automobile Mannequin Influence on Insurance coverage Prices

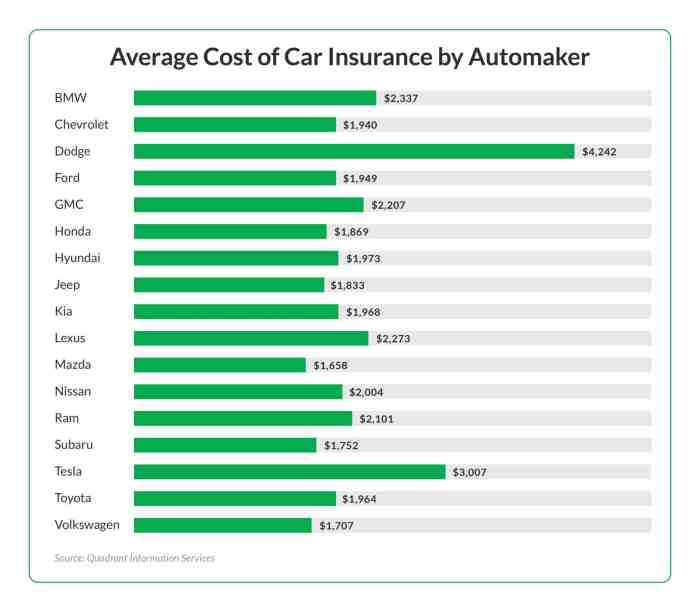

Completely different automobile fashions exhibit various ranges of security and restore prices. Insurance coverage corporations take into account these elements when figuring out premiums. Excessive-performance sports activities vehicles, for instance, typically have larger insurance coverage prices because of their higher potential for harm and restore bills. Sedans and SUVs usually fall inside a extra reasonable vary, whereas economical compact vehicles might have decrease premiums, reflecting their decrease restore and alternative values.

Insurance coverage corporations additionally take into account the make and mannequin’s historical past of reported accidents or recollects, influencing the danger evaluation.

Driving Historical past’s Impact on Charges

Driving historical past is a vital consider figuring out insurance coverage premiums. A clear driving document, free from accidents and site visitors violations, usually results in decrease premiums. Conversely, accidents, dashing tickets, and different violations enhance the perceived danger, leading to larger insurance coverage prices. Insurance coverage corporations analyze previous driving information to estimate the probability of future claims.

Location’s Affect on Insurance coverage Prices

Geographic location considerably impacts insurance coverage charges. City areas typically have larger insurance coverage prices in comparison with rural areas. This distinction stems from elements like larger accident charges, elevated site visitors congestion, and probably tougher driving circumstances in cities. Rural areas, with decrease accident charges and fewer site visitors incidents, sometimes end in decrease insurance coverage premiums.

Age and Gender’s Function in Insurance coverage Charges

Statistical knowledge demonstrates that youthful drivers typically have larger premiums in comparison with older drivers. This displays a better danger evaluation because of inexperience and probably larger accident charges amongst youthful drivers. Equally, gender-based premiums, whereas typically controversial, can generally exist, primarily based on historic knowledge concerning driving behaviors.

Comparability of Insurance coverage Prices Throughout Automobile Varieties

| Automobile Sort | Typical Insurance coverage Price Influence | Instance |

|---|---|---|

| Sports activities Vehicles | Typically larger because of larger restore prices, potential for higher-speed accidents, and perceived danger. | A Lamborghini may cost a little considerably extra to insure than a Honda Civic. |

| Sedans | Average insurance coverage prices, falling between sports activities vehicles and SUVs generally. | A Toyota Camry may need a reasonable insurance coverage premium. |

| SUVs | Reasonably larger than sedans because of elevated dimension and weight, however decrease than sports activities vehicles. | A Ford Explorer may need a barely larger premium than a Honda Accord. |

| Compact Vehicles | Typically decrease insurance coverage prices because of decrease restore prices and perceived danger. | A Toyota Yaris may need a decrease premium in comparison with a big SUV. |

Insurance coverage corporations use advanced algorithms to calculate premiums, making an allowance for numerous elements just like the automobile’s worth, driver historical past, location, and age. It’s important to grasp these elements to make knowledgeable choices about insurance coverage selections.

New Automobile Insurance coverage vs. Used Automobile Insurance coverage

New automobile insurance coverage typically carries a unique price ticket in comparison with insuring a used automobile. This disparity stems from a number of key elements, together with the automobile’s worth, its age, and the extent of danger related to its possession. Understanding these variations is essential for anybody seeking to safe probably the most aggressive charges for his or her automobile.

Insurance coverage Price Variations

Insurance coverage corporations meticulously assess danger when figuring out premiums. A brand new automobile, sometimes representing a better preliminary funding, presents a better potential for monetary loss within the occasion of an accident or theft. This elevated danger interprets to larger premiums for the proprietor of a brand new automobile in comparison with a comparable used automobile. Furthermore, a brand new automobile typically comes with extra superior security options, however the absence of those options in a used automobile could be a consideration in the price of insurance coverage.

Influence of Car Worth

The automobile’s worth instantly influences the insurance coverage premium. Insurance coverage insurance policies are sometimes calculated primarily based on the automobile’s alternative price. A more moderen, dearer automobile will command a better premium in comparison with an older, much less priceless mannequin. The potential monetary loss within the occasion of a complete loss is a important determinant in insurance coverage pricing.

Illustrative Examples

Think about two related fashions, a 2024 Sedan and a 2021 Sedan. Assuming comparable driving information and protection ranges, the 2024 mannequin will possible have a better insurance coverage premium. It is because the 2024 mannequin’s alternative worth is larger. A hypothetical situation entails a 2024 mannequin valued at $30,000, and a 2021 mannequin valued at $20,000. The insurance coverage premium for the 2024 mannequin could be roughly 15-20% larger than the 2021 mannequin, all different elements being equal.

Comparability Desk, Is insurance coverage cheaper on a brand new automobile

| Characteristic | New Automobile | Used Automobile |

|---|---|---|

| Car Worth | Greater | Decrease |

| Insurance coverage Premium | Sometimes Greater | Sometimes Decrease |

| Danger Evaluation | Greater potential loss | Decrease potential loss |

| Security Options | Probably extra superior | Probably much less superior |

| Age of Car | New | Used |

Reductions and Advantages for New Automobile House owners: Is Insurance coverage Cheaper On A New Automobile

New automobile homeowners typically get pleasure from engaging insurance coverage reductions and advantages. These incentives can considerably cut back insurance coverage premiums, making automobile possession extra inexpensive. Understanding these perks may also help new automobile homeowners lower your expenses on their insurance coverage insurance policies.

Potential Reductions for New Automobile House owners

Insurance coverage corporations regularly supply reductions to new automobile homeowners, reflecting the decrease danger profile related to newer autos. These reductions are designed to incentivize accountable possession and reward the funding in a brand new, well-maintained automobile. The potential for financial savings might be substantial, significantly when coupled with different reductions.

Procedures for Claiming New Automobile Reductions

Claiming reductions typically entails offering the insurance coverage firm with particular documentation, just like the automobile’s registration or buy settlement. New automobile homeowners should guarantee they preserve all related paperwork, as that is essential for verifying eligibility for reductions. Failure to supply obligatory paperwork can result in the denial of reductions. Insurance coverage corporations sometimes have clear tips on the required documentation, which needs to be available on their web sites or by way of customer support channels.

Insurance coverage Firm Danger Evaluation of New Vehicles

Insurance coverage corporations meticulously assess danger elements related to new vehicles. Components just like the automobile’s make, mannequin, security options, and the driving force’s historical past are all thought of. The newer the automobile, the decrease the perceived danger of accidents and harm. Moreover, superior security options in new vehicles contribute to a decrease danger profile, which instantly interprets to probably decrease premiums.

These elements are meticulously evaluated within the actuarial fashions employed by insurance coverage corporations to find out premium charges.

Examples of Particular Reductions for New Automobile House owners

New automobile homeowners would possibly qualify for reductions on insurance coverage premiums. Examples embrace reductions for brand new drivers who’re underneath a sure age or have accomplished driver’s training programs. Likewise, particular automobile fashions or options might set off reductions. For instance, a automobile with superior security know-how would possibly qualify for a selected low cost.

Potential Financial savings for New Automobile House owners

New automobile homeowners can probably save vital quantities on insurance coverage in comparison with used automobile homeowners. The decrease danger related to new vehicles typically interprets to decrease premiums. This financial savings potential might be substantial, relying on the particular automobile, the driving force’s profile, and the insurance coverage firm’s insurance policies. As an example, a brand new driver with a brand new automobile and good driving historical past would possibly expertise vital financial savings in comparison with a driver with a used automobile and a much less favorable driving document.

Desk of Reductions and Advantages

| Low cost Sort | Description |

|---|---|

| New Automobile Low cost | Diminished premiums for brand new autos primarily based on their decrease danger profile. |

| New Driver Low cost | Reductions for drivers underneath a selected age or who’ve accomplished driver’s teaching programs. |

| Security Characteristic Low cost | Reductions for autos outfitted with superior security options, like airbags or anti-lock brakes. |

| Good Driver Low cost | Reductions for drivers with a clear driving document. |

| Bundled Insurance coverage Low cost | Reductions for combining a number of insurance coverage insurance policies (e.g., house and auto). |

Insurance coverage Protection Choices for New Vehicles

Navigating the world of automobile insurance coverage might be daunting, particularly when coping with a brand-new automobile. Understanding the particular protection choices out there for brand new vehicles, contrasting them with these for used vehicles, and the related prices is essential for making knowledgeable choices. This part particulars the usual protection choices, highlights key variations, and analyzes the impression of add-on coverages on premiums.

Commonplace Protection Choices for New Vehicles

New automobile insurance coverage sometimes features a mixture of ordinary coverages designed to guard in opposition to numerous potential dangers. These typically embrace legal responsibility protection, which protects you from monetary duty for those who trigger harm to a different particular person’s property or damage to them. Collision protection protects you in case your automobile is broken in an accident, no matter who’s at fault. Complete protection, then again, covers damages from occasions aside from collisions, resembling vandalism, theft, or weather-related incidents.

Understanding these basic elements is step one to making sure complete safety.

Variations in Protection Choices Between New and Used Vehicles

Whereas the elemental coverages (legal responsibility, collision, and complete) are usually related for each new and used vehicles, the specifics can range. Insurance coverage corporations might modify protection quantities primarily based on the automobile’s worth and market situation. New vehicles, being extra priceless and probably extra inclined to break because of the newer elements, typically include larger protection limits for collision and complete harm.

Used vehicles, with their decrease worth and probably larger put on and tear, sometimes have decrease protection limits for a majority of these harm.

Forms of Insurance coverage Protection for Completely different Forms of Damages

Several types of insurance coverage protection handle various kinds of damages. Legal responsibility insurance coverage protects you from monetary duty for damages you trigger to others. Collision protection pays for harm to your automobile in an accident, no matter fault. Complete protection pays for harm to your automobile from occasions aside from collisions, resembling vandalism, theft, hearth, or hail harm. Understanding these distinct coverages is crucial for tailor-made safety.

Comparability of Protection Supplied for New vs. Used Vehicles

A brand new automobile of a specific mannequin and worth will sometimes have larger limits for collision and complete protection in comparison with a used automobile of comparable worth. It is because the alternative price of a brand new automobile is larger. Insurance coverage corporations issue on this larger worth and potential for higher loss when figuring out protection limits for brand new vehicles.

Nonetheless, this distinction in protection typically displays the upper price of insurance coverage for a brand new automobile. As an example, a used automobile with an identical market worth to a brand new automobile might solely have protection as much as a certain quantity for collision and complete, whereas a brand new automobile can have a better protection restrict.

Influence of Add-on Protection Choices on Insurance coverage Premiums

Add-on protection choices, resembling uninsured/underinsured motorist protection, roadside help, and rental automobile reimbursement, can considerably impression insurance coverage premiums. Including these options to your coverage often will increase the associated fee. The premium enhance varies relying on the particular protection and the supplier. For instance, including uninsured/underinsured motorist protection to guard in opposition to drivers with out insurance coverage can enhance the premium, but it surely’s essential for safeguarding your monetary pursuits within the occasion of an accident with a negligent driver.

Insurance coverage Protection Choices for New Vehicles: A Price Comparability

| Protection Sort | Description | Typical Price for New Automobile (Instance) |

|---|---|---|

| Legal responsibility | Protects in opposition to monetary duty for damages to others. | $100-$300 per yr |

| Collision | Covers harm to your automobile in an accident, no matter fault. | $200-$500 per yr |

| Complete | Covers harm to your automobile from occasions aside from collisions (e.g., vandalism, theft, climate). | $150-$400 per yr |

| Uninsured/Underinsured Motorist | Protects in opposition to drivers with out insurance coverage or these with inadequate protection. | $50-$200 per yr |

| Roadside Help | Supplies help in case of auto breakdown. | $50-$100 per yr |

Be aware: Prices are examples and should range considerably primarily based on elements just like the automobile mannequin, location, and driving historical past.

Evaluating Insurance coverage Suppliers for New Vehicles

Securing the fitting insurance coverage coverage on your newly acquired automobile is essential. Understanding the nuances of various suppliers and their pricing buildings is vital to getting the absolute best deal. This entails extra than simply evaluating premiums; it is about analyzing the protection, deductibles, and potential reductions provided by every firm.Evaluating insurance coverage quotes from a number of suppliers is crucial for securing probably the most aggressive charges.

This course of typically entails offering particular particulars concerning the automobile, resembling its make, mannequin, yr, and choices. It is necessary to keep in mind that insurance coverage corporations assess danger in a different way, and understanding their standards may also help you make an knowledgeable choice.

Acquiring Quotes from Completely different Insurance coverage Firms

Gathering quotes from numerous suppliers is an easy course of. Begin by figuring out respected insurance coverage corporations in your space. Subsequent, go to their web sites or contact their customer support representatives to request quotes. Crucially, present correct details about the brand new automobile’s specs, in addition to your driving historical past and site. The extra correct the info, the extra exact the quote can be.

Insurance coverage corporations might use on-line quote calculators or require you to finish an software type.

Insurance coverage Firm Danger Evaluation for New Vehicles

Insurance coverage corporations make use of numerous strategies to evaluate danger for brand new vehicles. Components thought of embrace the automobile’s make, mannequin, and security options. A automobile with superior security options would possibly entice a decrease premium, demonstrating a decrease danger profile. The automobile’s efficiency traits, resembling horsepower and acceleration, also can play a job. Driving historical past, significantly accident information, and site are vital elements.

Firms may additionally use knowledge analytics and algorithms to foretell future claims primarily based on historic tendencies.

Components to Think about When Selecting an Insurance coverage Supplier

A number of key elements ought to information your choice when choosing an insurance coverage supplier. Firstly, consider the various kinds of protection provided and guarantee they align along with your wants and funds. Secondly, perceive the deductibles and their impression in your out-of-pocket bills. Thirdly, pay shut consideration to the potential reductions out there. Lastly, take into account the corporate’s fame and customer support document.

Learn evaluations and examine the phrases of service.

Strategies for Evaluating Insurance coverage Insurance policies

Examine insurance policies utilizing a structured method. Create a spreadsheet or use a comparability instrument to record completely different insurance coverage suppliers and their corresponding premiums. Embody particulars like protection sorts, deductibles, and any out there reductions. By systematically itemizing these points, you’ll be able to simply examine completely different insurance policies and establish the perfect match. Take note of the tremendous print of every coverage, guaranteeing you perceive the phrases and circumstances earlier than making a choice.

Insurance coverage Supplier Comparability Desk for New Vehicles

| Insurance coverage Supplier | Premium (Instance) | Protection Choices | Reductions Supplied | Deductible |

|---|---|---|---|---|

| Firm A | $1500 per yr | Complete, Collision, Legal responsibility | Multi-car low cost, Good pupil low cost | $500 |

| Firm B | $1700 per yr | Complete, Collision, Legal responsibility, Uninsured Motorist | Multi-car low cost, Defensive Driving Course | $1000 |

| Firm C | $1350 per yr | Complete, Collision, Legal responsibility | Bundled insurance coverage low cost, New Automobile low cost | $500 |

Be aware: Premiums are examples and should range primarily based on particular person circumstances.

Ideas and Methods for Decreasing New Automobile Insurance coverage Prices

Proudly owning a brand new automobile is an thrilling expertise, however the related insurance coverage prices can generally be a big monetary burden. Understanding methods to decrease premiums is essential for managing these bills successfully. Implementing the following tips can prevent cash and make sure you’re well-protected with out breaking the financial institution.A well-maintained driving document and accountable driving habits are key elements in securing favorable insurance coverage charges.

Proactive measures like benefiting from out there reductions and evaluating quotes from completely different suppliers can additional optimize your insurance coverage expenditure.

Sustaining a Superior Driving Document

A clear driving document is paramount in securing aggressive insurance coverage charges. Accidents and site visitors violations instantly impression insurance coverage premiums. Constant protected driving habits are important for constructing and sustaining a constructive driving historical past. A clear document demonstrates accountable conduct on the street and displays a decrease danger profile to insurers. This interprets into probably decrease premiums.

Driver Training Packages

Driver teaching programs are priceless assets for brand new drivers and skilled ones alike. These packages supply complete coaching in protected driving strategies, accident avoidance, and defensive driving methods. Finishing a acknowledged driver training program can improve your driving expertise and data, probably resulting in a discount in your insurance coverage premiums.

Protected Driving Practices

Protected driving practices embody a variety of behaviors that contribute to accident prevention. These embrace adhering to hurry limits, avoiding distracted driving, and sustaining a protected following distance. Repeatedly practising protected driving strategies not solely reduces the danger of accidents but additionally demonstrates accountable driving habits, which might favorably impression insurance coverage premiums. Utilizing seatbelts, avoiding alcohol and medicines whereas driving, and guaranteeing correct automobile upkeep additionally contribute to a safer driving profile.

Actionable Steps to Cut back Premiums

- Preserve a Clear Driving Document: Keep away from any site visitors violations or accidents. That is the only most vital consider controlling your insurance coverage prices.

- Take a Defensive Driving Course: Many insurance coverage corporations supply reductions for finishing defensive driving programs. These programs train you strategies to keep away from accidents and enhance your driving expertise.

- Examine Insurance coverage Quotes: Do not accept the primary quote you obtain. Store round and examine quotes from a number of insurance coverage suppliers. This lets you establish probably the most aggressive charges on your state of affairs.

- Think about Bundling Insurance coverage: If in case you have a number of insurance coverage wants (house, auto, and so forth.), take into account bundling them with the identical supplier. Many corporations supply reductions for bundling.

- Overview and Replace Your Protection Wants: Repeatedly consider your protection wants and modify your coverage accordingly. Guarantee you will have satisfactory protection however keep away from pointless extras that drive up premiums.

- Pay Premiums in Full and on Time: Constant funds exhibit monetary duty, which might positively impression your insurance coverage charges.

Final Recap

In conclusion, whereas a brand new automobile would possibly appear to be a no brainer for financial savings, the precise price of insurance coverage is not at all times clear-cut. It is a balancing act between the elements talked about, and discovering the perfect deal requires comparability procuring and understanding your personal state of affairs. Hopefully, this information has given you a clearer image of the ins and outs of recent automobile insurance coverage, so you can also make an knowledgeable choice.

FAQ Overview

Is insurance coverage at all times cheaper on a model new automobile?

No, not essentially. Whereas a brand new automobile may need decrease premiums in some circumstances, elements like your driving document and the automobile’s worth play a big function. Generally, a well-maintained used automobile can have decrease premiums.

What reductions can be found for brand new automobile homeowners?

Many insurance coverage corporations supply reductions for brand new automobile homeowners, typically tied to particular packages or options. These might embrace new driver reductions, security options reductions, or loyalty packages. Verify along with your insurer for particular particulars.

How does my driving historical past have an effect on my new automobile insurance coverage?

Your driving historical past, together with any accidents or site visitors violations, is a vital consider figuring out your insurance coverage charges. A clear driving document usually interprets to decrease premiums.

Can I get a greater insurance coverage quote from a unique supplier?

Undoubtedly! It is at all times smart to match quotes from a number of insurance coverage suppliers. This helps make sure you’re getting the absolute best price on your new automobile.