Do I want insurance coverage to register my automobile? That is a vital query for any new driver or automobile proprietor. Getting your trip on the highway legally is essential, and insurance coverage typically performs a giant function. It is not simply concerning the paperwork, it is about defending your self and others on the highway. This overview digs deep into the legalities, insurance coverage varieties, and the entire means of registering your automobile, together with potential exemptions and alternate options.

Navigating the foundations and laws for automobile registration could be tough, particularly when insurance coverage comes into the image. Totally different locations have completely different guidelines, and understanding what you’ll want to do in your particular space is important. This information will break down the complexities into easy-to-understand steps, serving to you perceive the insurance coverage necessities for registering your automobile.

Authorized Necessities for Automobile Registration

The journey of proudly owning a car is commonly paved with authorized intricacies. Understanding these necessities is essential, as compliance ensures not solely easy operation but in addition fosters a way of accountability and reference to the broader societal framework. Navigating these laws can appear daunting, however with a transparent understanding, the method turns into much less complicated and extra empowering.

Overview of Automobile Registration Legal guidelines

Automobile registration legal guidelines differ considerably throughout jurisdictions, reflecting distinctive cultural and infrastructural wants. These laws dictate the authorized procedures for documenting possession and sustaining the legitimacy of a car’s use. The exact necessities differ, however the elementary rules stay constant— guaranteeing public security and sustaining orderly car administration.

Automobile Kind-Particular Registration Guidelines

Several types of automobiles have various registration necessities. Vehicles, bikes, and vans, as an illustration, have completely different documentation and inspection protocols. These variations mirror the distinct operational traits and potential hazards related to every car kind. As an illustration, bikes, on account of their decrease mass and potential for greater speeds, might have extra stringent security necessities.

Important Documentation for Automobile Registration

Correct and full documentation is paramount for a easy registration course of. This usually includes proof of possession, car identification particulars, and cost of relevant charges. Totally different jurisdictions would possibly demand particular supporting paperwork, similar to proof of insurance coverage, emission take a look at outcomes, or title switch types.

Penalties for Working an Unregistered Automobile

Failure to adjust to registration necessities carries vital penalties. These sanctions typically embrace fines, impoundment of the car, and potential authorized repercussions. The penalties differ relying on the jurisdiction and the severity of the violation. The seriousness of the penalties highlights the significance of adhering to authorized protocols.

Insurance coverage’s Function within the Registration Course of

Insurance coverage performs a important function within the registration course of in lots of jurisdictions. It typically serves as a prerequisite for acquiring a registration certificates. Insurance coverage necessities differ primarily based on elements just like the car kind, the motive force’s historical past, and the precise state legal guidelines. This safeguard promotes security and accountability for potential injury or damage ensuing from car operation.

US State-Particular Insurance coverage Necessities

| State | Insurance coverage Required | Particulars |

|---|---|---|

| California | Sure | Proof of legal responsibility insurance coverage is necessary for car registration. |

| Texas | Sure | Proof of economic accountability, typically met by legal responsibility insurance coverage, is required. |

| New York | Sure | Legal responsibility insurance coverage is required for car registration. Particular particulars can be found on the DMV web site. |

| Florida | Sure | Proof of insurance coverage is a prerequisite for car registration. |

| Illinois | Sure | Proof of insurance coverage is required for registration. |

This desk gives a glimpse into the insurance coverage necessities for car registration in choose US states. Be aware that this isn’t an exhaustive checklist, and particular particulars are greatest obtained from the respective state’s Division of Motor Autos (DMV) web sites. The data on this desk is present as of the final replace. Rules are dynamic, and it’s advisable to confirm the newest tips from official sources.

Insurance coverage Varieties: Do I Want Insurance coverage To Register My Automotive

The tapestry of auto insurance coverage, a significant thread within the material of accountable possession, affords a spectrum of protections. Understanding these numerous varieties permits drivers to navigate the complexities of the highway with a way of safety, understanding that their monetary well-being is aligned with their non secular journey of accountable motoring.Choosing the proper insurance coverage protection is akin to choosing a private mantra, aligning together with your particular wants and monetary concord.

It’s a reflection of your dedication to safeguarding your car and, extra importantly, to the rules of security and peace of thoughts that underpins accountable driving.

Totally different Forms of Automobile Insurance coverage

Varied insurance coverage choices can be found, every tailor-made to particular wants and monetary conditions. These selections, starting from essentially the most primary to essentially the most complete, supply completely different levels of safety, like layers of a protecting aura.

- Legal responsibility Insurance coverage: This foundational type of protection protects you financially if you’re at fault in an accident. It usually covers the opposite social gathering’s damages and accidents. This kind of insurance coverage is akin to acknowledging the karmic connection between your actions and the implications, acknowledging accountability for the potential repercussions of your actions on the highway.

- Collision Insurance coverage: This kind of insurance coverage covers damages to your car in an accident, no matter who’s at fault. It is like having a safeguard towards the unpredictable nature of the highway, guaranteeing your car stays a dependable companion.

- Complete Insurance coverage: This broader protection extends past accidents, together with safety towards incidents similar to theft, vandalism, hearth, or pure disasters. It is a complete defend, encompassing a variety of potential perils.

- Uninsured/Underinsured Motorist Protection: This protection steps in in case you’re concerned in an accident with a driver who lacks ample insurance coverage or is uninsured. It acts as a security internet, safeguarding your monetary well-being within the face of such unpredictable conditions.

Protection and Price Comparability

The selection of insurance coverage kind straight correlates with the extent of economic safety. A deeper understanding of the protection supplied by every kind, coupled with a transparent consciousness of the related prices, permits knowledgeable decision-making.

| Insurance coverage Kind | Protection | Price |

|---|---|---|

| Legal responsibility | Covers different social gathering’s damages and accidents if you’re at fault. | Typically decrease than different varieties. |

| Collision | Covers damages to your car in an accident, no matter fault. | Reasonable value. |

| Complete | Covers damages to your car from occasions past accidents (theft, vandalism, hearth). | Larger than legal responsibility and collision, however decrease than full protection. |

| Uninsured/Underinsured Motorist | Protects you if concerned in an accident with an uninsured or underinsured driver. | Variable; typically included as an add-on to different varieties. |

Components Influencing Insurance coverage Prices, Do i would like insurance coverage to register my automobile

A number of components affect the premium of your car insurance coverage. Understanding these elements empowers you to make knowledgeable choices.

- Automobile Kind and Worth: The worth and kind of your car straight affect the premium. Larger-value automobiles, notably these which can be extra more likely to be focused by thieves, usually have greater premiums.

- Driver Historical past: Your driving report, together with accidents, violations, and claims, performs a major function in figuring out your premium. A clear driving report typically interprets to a decrease premium.

- Location: The situation the place you reside and park your car can affect your insurance coverage prices. Excessive-risk areas typically result in greater premiums.

- Utilization: The frequency and goal of your car utilization (e.g., commuting, driving for enterprise) might have an effect on the premium. Frequent and intensive use would possibly result in the next premium.

- Deductible Quantity: The quantity you conform to pay out of pocket earlier than your insurance coverage protection kicks in. The next deductible usually results in a decrease premium.

Insurance coverage and Registration Course of

Embarking on the journey of proudly owning a car necessitates understanding the interconnectedness of insurance coverage and registration. These processes, typically perceived as bureaucratic hurdles, are integral to making sure accountable possession and safeguarding your funding. A deep understanding fosters a harmonious alignment between your car and your non secular well-being, selling a way of safety and peace of thoughts.The method of registering a car is a vital step in legally claiming possession.

Insurance coverage acts as a cornerstone of this course of, offering a security internet for unexpected circumstances. This concord between these two components empowers you to navigate the intricacies of auto possession with readability and beauty.

Typical Steps in Automobile Registration

The method of registering a car usually includes a collection of steps, every contributing to the seamless transition from potential proprietor to registered proprietor. These steps, although seemingly mundane, are important for the safety and integrity of all the system.

- Software Submission: Initiating the registration course of includes submitting a complete software kind, typically accompanied by supporting paperwork. This formalizes the intent to register the car and initiates the authorized recognition of possession.

- Verification and Evaluation: Authorities confirm the knowledge supplied within the software towards their information, guaranteeing accuracy and legitimacy. This thorough examination is important for stopping fraudulent exercise and sustaining the integrity of the registration system.

- Fee of Charges: A prescribed payment, reflecting administrative prices and public companies, is usually due for processing the registration. This cost acts as a type of acknowledgment and monetary dedication to the registration course of.

- Issuance of Registration Paperwork: Upon profitable completion of the verification and cost, the authorities subject registration paperwork, together with the car registration certificates. This doc serves as proof of possession and authorized authorization to function the car.

Function of Insurance coverage within the Registration Course of

Insurance coverage performs a pivotal function within the car registration course of. It acts as a significant hyperlink between the proprietor and the authorized framework, demonstrating accountable possession.

- Authorized Requirement: In lots of jurisdictions, insurance coverage is a compulsory requirement for car registration. This requirement protects each the proprietor and most of the people by guaranteeing that monetary accountability is in place to cowl potential liabilities.

- Monetary Safety: Insurance coverage gives a monetary security internet in case of accidents or damages. This safeguards the proprietor from vital monetary burdens, permitting for a safer and steady expertise with the car.

- Clean Registration Course of: Insurance coverage, by satisfying a prerequisite, facilitates the graceful registration course of. This alignment ensures that the registration course of proceeds with out problems, saving effort and time.

Acquiring Automobile Insurance coverage for Registration

Acquiring car insurance coverage is a vital side of the registration course of. It is a matter of accountability and guaranteeing the protection of your self and others on the highway.

- Researching Insurance coverage Suppliers: Researching completely different insurance coverage suppliers is a crucial step. Examine protection, premiums, and buyer critiques to pick out the most suitable choice that aligns together with your wants and price range. Take into account elements like protection limits, coverage phrases, and customer support repute.

- Coverage Choice: Select a coverage that meets your wants and adheres to the necessities of your jurisdiction. This step ensures that you’re adequately coated for varied potential situations and authorized necessities.

- Coverage Software: Full the appliance kind precisely and supply all vital documentation. This ensures the insurance coverage supplier can assess your wants precisely and supply an acceptable coverage.

- Coverage Issuance: Upon profitable software and verification, the insurance coverage supplier points the coverage doc, together with particulars of protection, premiums, and different related info. Evaluate this doc rigorously to grasp your protection and tasks.

Documentation Required for Automobile Insurance coverage

Varied paperwork are required for acquiring car insurance coverage. Every doc performs a important function in verifying your identification and the car’s particulars.

- Proof of Id: A legitimate driver’s license or different types of identification, as required by the jurisdiction.

- Automobile Particulars: The car’s registration quantity, make, mannequin, and yr of manufacture.

- Driving Historical past: Particulars of your driving report, together with any previous accidents or violations.

- Handle Proof: Proof of present residential handle, similar to utility payments or financial institution statements.

Automobile Registration With out Insurance coverage

Registering a car with out insurance coverage is commonly prohibited by regulation in most jurisdictions. It’s a violation that may result in penalties.

- Authorized Penalties: Failure to adjust to insurance coverage necessities can result in penalties or fines.

- Suspension of Registration: In some instances, failure to satisfy insurance coverage necessities can lead to the suspension or revocation of the car’s registration.

- Operational Restrictions: With out correct insurance coverage, working the car could also be prohibited or restricted.

Insurance coverage Impression on Automobile Registration Price

The price of car registration is commonly influenced by insurance coverage. A complete coverage might contribute to the next registration payment, whereas a primary coverage might end in a decrease payment.

- Premium Impression: Larger insurance coverage premiums usually end in the next registration payment.

- Protection Ranges: Insurance coverage protection ranges affect registration charges in some jurisdictions. Larger protection ranges can improve charges, whereas decrease protection ranges would possibly lower them.

- Coverage Varieties: Totally different coverage varieties might have an effect on the price of car registration. Complete insurance policies would possibly result in greater registration prices in comparison with insurance policies with restricted protection.

Automobile Registration Flowchart

[A detailed flowchart illustrating the steps involved in vehicle registration, including insurance requirements, would be presented here. It would visually depict the process, highlighting the connections between steps and the crucial role of insurance.]

Exemptions and Exceptions

Navigating the labyrinth of auto registration legal guidelines can typically really feel like deciphering an historic prophecy. However understanding the exemptions and exceptions reveals a hidden concord inside the system, a nuanced method to regulation that acknowledges numerous circumstances. This understanding empowers people to make knowledgeable selections, aligning their actions with the spirit of the regulation.The idea of exemptions from insurance coverage necessities for car registration is not about circumventing the system, however slightly about recognizing particular conditions the place the normal requirement would not align with the distinctive circumstances of the person or car.

This typically includes a steadiness between public security and particular person rights, the place the need of insurance coverage is assessed towards the character of the meant use of the car.

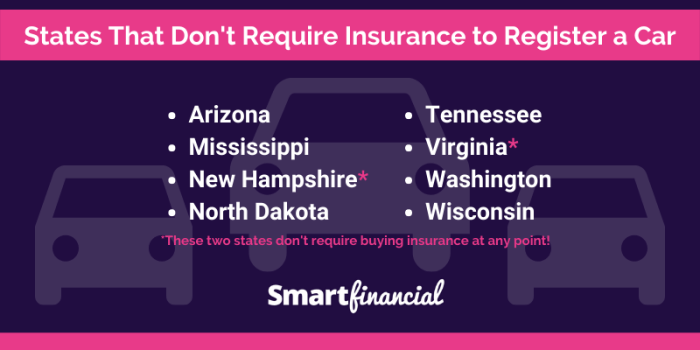

Conditions Requiring No Insurance coverage for Registration

Exemptions should not common; their existence is determined by the precise jurisdiction and the kind of car. Understanding these nuances is essential for correct interpretation. Sure makes use of of automobiles would possibly fall outdoors the scope of typical insurance coverage necessities.

- Vintage or traditional automobiles, typically maintained in a preserved situation and pushed occasionally, might qualify for exemptions in some areas. The rarity and historic significance of those automobiles can typically justify a lowered insurance coverage requirement or a whole exemption.

- Autos used completely for agricultural functions, similar to farm tractors or specialised gear, could also be exempt or have decreased insurance coverage necessities in some jurisdictions. The character of the work and the car’s use dictate the extent of insurance coverage wanted, with exemptions extra probably for automobiles used solely for agricultural duties.

- Autos used solely for non secular functions or charitable work would possibly obtain comparable consideration. The aim of the car’s use is commonly a key think about figuring out the need of insurance coverage, with exemptions doubtlessly granted for actions aligned with charitable or non secular targets.

Particular Exemptions by Automobile Kind

The exemption framework can differ considerably primarily based on the kind of car. This intricate internet of laws ensures a custom-made method that considers the distinctive traits of every car.

- Leisure Autos (RVs): Sure RVs, similar to these used solely for leisure functions, might qualify for decreased insurance coverage necessities or exemptions. The frequency of use and the meant vacation spot play a significant function in figuring out the required protection.

- Off-Street Autos (ORVs): ORVs used primarily for leisure off-road actions could be eligible for various insurance coverage necessities or exemptions. The character of the terrain and the extent of the car’s off-road utilization decide the need of insurance coverage protection.

- Low-Velocity Autos (LSVs): These automobiles, typically characterised by their decrease velocity and restricted use, could be exempt from conventional insurance coverage necessities in some jurisdictions. The low velocity and restricted use of the car are essential elements in figuring out the extent of insurance coverage required.

Situations for Claiming an Exemption

The standards for claiming an exemption differ throughout jurisdictions. Rigorous documentation is commonly essential to show that the car meets the situations of the exemption.

- Proof of auto’s historic significance (for antiques or classics) could also be required, similar to documentation from historic societies or professional value determinations.

- Detailed information of the car’s agricultural use, together with particular dates, places, and functions, could also be vital for claiming agricultural exemptions.

- Documentation of the car’s meant use for non secular or charitable functions, together with related certifications, could be vital.

Comparability of Exemptions Throughout Jurisdictions

Exemptions differ considerably between jurisdictions. This necessitates a radical investigation into the precise laws inside every space.

| Automobile Kind | Jurisdiction | Particulars |

|---|---|---|

| Vintage Automotive | California | Requires proof of historic significance, restricted use. |

| Vintage Automotive | New York | Requires proof of historic significance, restricted use, and particular registration. |

| Agricultural Tractor | Iowa | Exempt from insurance coverage if used solely for agricultural functions. |

| Agricultural Tractor | Texas | Requires particular documentation of agricultural use and car kind. |

Course of for Making use of for Exemptions

The applying course of for exemptions typically includes particular steps and documentation necessities.

- Collect all related paperwork, together with car registration particulars, historic information, and documentation of meant use.

- Contact the suitable authorities to find out the precise software process and required documentation.

- Submit the finished software kind and all vital paperwork to the related division inside the jurisdiction.

Alternate options to Conventional Insurance coverage

Embarking on the journey of auto possession typically necessitates navigating the labyrinthine world of insurance coverage. Conventional fashions, whereas prevalent, won’t resonate with each soul looking for concord with their car. Past the acquainted contours of typical insurance policies, various avenues beckon, promising a special perspective on securing your car’s well-being. These pathways, although typically much less traveled, can unveil distinctive advantages and insights into the broader spectrum of safety.

Various Insurance coverage Strategies

Various insurance coverage strategies embody a various vary of approaches, every providing a novel perspective on car safety. These choices typically faucet into shared accountability and community-based options, difficult the normal paradigm of particular person contracts.

Advantages and Drawbacks of Various Options

Various insurance coverage options, whereas doubtlessly providing cost-effectiveness and a special method to danger administration, might not all the time present the identical stage of protection as conventional insurance policies. Some strategies would possibly place a larger emphasis on neighborhood assist or shared accountability, whereas others would possibly contain the next diploma of self-reliance or private danger evaluation. Rigorously evaluating the advantages and disadvantages is important in aligning the chosen resolution with one’s particular wants and values.

Examples of Various Insurance coverage Suppliers

Quite a few various insurance coverage suppliers cater to numerous wants and preferences. Some deal with particular demographics, like younger drivers or these with a historical past of accidents, providing tailor-made packages. Others would possibly leverage know-how to streamline processes or supply versatile cost constructions. The rise of peer-to-peer insurance coverage fashions, the place people share danger and accountability, can be a rising development. Additional examples embrace community-based insurance coverage schemes, and cooperatives providing reasonably priced protection choices.

Impression on Automobile Registration

The affect of different insurance coverage on car registration can differ relying on the precise program. Some might require extra documentation or verification steps, whereas others would possibly seamlessly combine into current registration processes. Clear communication and understanding of the precise necessities are essential to make sure easy registration procedures.

Comparability of Prices

The price of various insurance coverage options can differ considerably from conventional premiums. Usually, these various strategies purpose to supply extra reasonably priced choices. Nonetheless, this may be contingent on the extent of protection, the precise supplier, and the chosen car. Evaluating the prices of each conventional and various insurance coverage, factoring in protection ranges and related charges, is important in making an knowledgeable resolution.

Execs and Cons of Various Insurance coverage

Various insurance coverage affords a novel perspective on car safety. It’d supply a extra collaborative method to danger administration and value financial savings. Nonetheless, the protection might not match the comprehensiveness of conventional insurance policies, doubtlessly requiring cautious analysis of protection gaps and exclusions. The shortage of intensive regulation and standardization in some various strategies may additionally pose potential dangers. Moreover, the dependability of the neighborhood side and long-term stability of the insurance coverage supplier should be rigorously assessed.

Impression on Driving Privileges

The act of driving, a elementary freedom, is interwoven with tasks, paramount amongst them being adherence to authorized laws. Failing to satisfy these obligations, particularly regarding car registration and insurance coverage, can have profound penalties, affecting not solely your materials well-being but in addition your capacity to freely navigate the roadways. This part delves into the non secular implications of neglecting these important facets of accountable driving.The soul’s journey on the earthly aircraft is commonly mirrored within the car, a vessel of transit.

Correct insurance coverage and registration symbolize the moral and authorized underpinnings of this journey, guaranteeing your non secular accountability to the neighborhood and your self. Neglecting these obligations can lead to a disruption of this harmonious journey.

Penalties of Driving With out Correct Insurance coverage and Registration

Failure to take care of correct car registration and insurance coverage can result in a disruption of the harmonious move of your non secular journey. This disharmony can manifest in varied types, from minor inconveniences to critical authorized ramifications. The non secular journey is greatest undertaken with the notice that one’s actions have karmic penalties, and neglecting these tasks might disrupt the equilibrium of the soul’s path.

Impression on Driving Privileges

Driving with out correct insurance coverage and registration is akin to traversing a non secular path with out the required steerage and safety. This lack of elementary requisites can severely curtail your driving privileges. Authorized techniques, performing because the guardians of societal order, are designed to safeguard the general public. With out insurance coverage, you’re unable to supply enough monetary recourse to these injured by your actions.

Penalties for Working a Automobile With out Insurance coverage or Correct Registration

Neglecting the necessities of insurance coverage and registration can set off a cascade of penalties, disrupting the graceful move of your driving privileges. These penalties function a reminder of the significance of fulfilling your obligations as a driver. The authorized system, a mirrored image of societal values, acts as a mediator to uphold the steadiness of justice. These penalties, starting from fines to suspension of driving privileges, are designed to discourage such conduct and preserve order on the roads.

Potential Authorized Points Arising from Driving With out Required Insurance coverage

Driving with out the required insurance coverage and registration can result in a fancy internet of authorized points. The non secular implications of such actions could be vital, doubtlessly making a discordance between your intentions and the truth of your actions. These authorized problems can result in vital monetary penalties and, extra importantly, the suspension of driving privileges, hindering your freedom of motion.

Potential Penalties of Driving With out Insurance coverage for Automobile Registration

Working a car with out the required insurance coverage and registration can have varied repercussions that reach past the rapid authorized penalties. These repercussions can manifest in disruptions to your non secular journey, highlighting the interconnectedness of our actions and their penalties.

- Suspension of driving privileges: This signifies a brief restriction in your capacity to navigate the roads, doubtlessly affecting your non secular journey. This interruption might function a lesson to reconnect with the moral and authorized tasks of driving.

- Monetary penalties: Fines imposed for working a car with out insurance coverage can disrupt the move of your monetary sources, affecting your non secular well-being. The monetary burden serves as a reminder of the significance of fulfilling your obligations.

- Authorized proceedings: If an accident happens, you might face authorized proceedings that may trigger vital misery and hinder your non secular journey. This serves as a warning towards negligence.

- Problem in acquiring future insurance coverage: A historical past of driving with out insurance coverage could make it difficult to acquire future insurance coverage protection, additional hindering your capacity to navigate the roads and impacting your non secular journey. The shortcoming to acquire insurance coverage might mirror a disconnect from the non secular accountability of driving.

- Elevated danger of accidents: Driving with out insurance coverage signifies an absence of accountability, growing the probability of accidents and inflicting hurt to your self and others. This highlights the non secular interconnectedness of actions and penalties.

Final Level

So, do you want insurance coverage to register your automobile? The brief reply is commonly sure, nevertheless it’s not a easy sure or no. Totally different places have completely different guidelines. This information has hopefully make clear the method, serving to you perceive the function of insurance coverage in registering your car. Bear in mind to all the time double-check the precise guidelines on your space for essentially the most correct info.

Continuously Requested Questions

Does insurance coverage have an effect on the price of automobile registration?

Sure, insurance coverage typically impacts the registration payment. Having the proper insurance coverage can affect the worth you pay to register your automobile.

What occurs if I haven’t got insurance coverage when registering my automobile?

You won’t be capable of register your automobile with out insurance coverage, and there could be penalties. Examine your native laws for the specifics.

Are there any exceptions to the insurance coverage requirement for automobile registration?

Sure, some jurisdictions may need exemptions for particular car varieties or conditions. You may wish to look into these exemptions on your space.

What are some various insurance coverage choices in addition to conventional automobile insurance coverage?

Some various choices would possibly exist, nevertheless it’s all the time greatest to totally analysis these choices, as they won’t cowl every part.