Low cost automobile insurance coverage Fort Myers is essential for drivers within the space. This information explores the native market, widespread elements affecting charges, and techniques for locating the perfect offers. We’ll cowl every part from evaluating insurance coverage firms to understanding completely different protection choices, serving to you navigate the complexities of automobile insurance coverage in Fort Myers.

From understanding the standard insurance coverage panorama in Fort Myers to figuring out particular reductions and protection wants, this complete information empowers you to make knowledgeable choices about your automobile insurance coverage. We’ll additionally spotlight native insurance coverage brokers and up to date developments out there, offering an entire image of your choices.

Overview of Fort Myers Automotive Insurance coverage

The automobile insurance coverage market in Fort Myers, Florida, displays the broader nationwide developments whereas exhibiting some native nuances. Components such because the area’s demographics, driving habits, and even the particular sorts of automobiles steadily pushed all contribute to the fee and availability of insurance coverage insurance policies. Understanding these elements is essential for anybody in search of inexpensive and complete protection.

Components Influencing Automotive Insurance coverage Charges in Fort Myers

A number of key components affect automobile insurance coverage premiums in Fort Myers. Demographics, together with age and driving historical past, play a major function. Youthful drivers, as an illustration, usually face increased premiums resulting from their perceived increased threat of accidents. Equally, a driver’s historical past of accidents or violations instantly impacts their insurance coverage prices. Automobile sort is one other necessary issue.

Excessive-performance sports activities vehicles, for instance, are sometimes costlier to insure resulting from their increased restore prices within the occasion of an accident.

Frequent Demographics in Fort Myers, Low cost automobile insurance coverage fort myers

Fort Myers’ demographics considerably affect insurance coverage charges. The realm has a mixture of youthful households, retirees, and people, all of which influence insurance coverage wants and premiums. Older drivers, for instance, typically expertise decrease premiums resulting from a statistically decrease accident price. This demographic combine necessitates numerous protection choices to fulfill the various insurance coverage wants of the inhabitants.

Typical Insurance coverage Firm Choices in Fort Myers

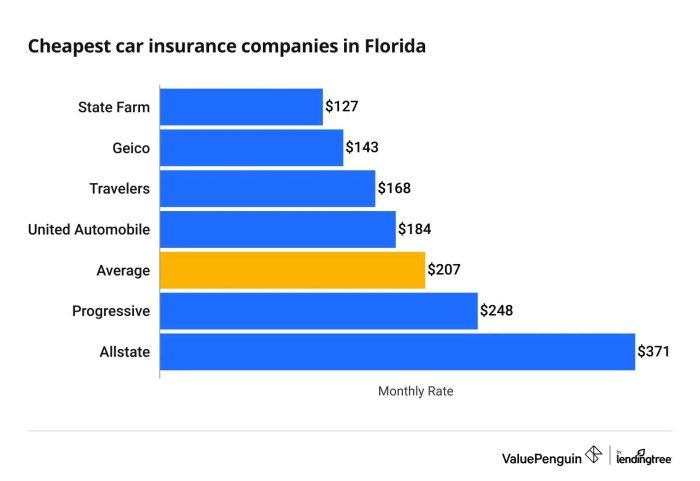

A wide range of insurance coverage firms provide protection in Fort Myers. Nationally acknowledged firms like State Farm, Allstate, and Geico, alongside regional suppliers, cater to the native market. These firms present a variety of protection choices and value factors, enabling people to search out insurance policies that align with their particular wants and budgets.

Comparability of Main Automotive Insurance coverage Corporations

| Firm Identify | Protection Choices | Premiums |

|---|---|---|

| State Farm | Complete protection, together with legal responsibility, collision, and uninsured/underinsured motorist safety. They steadily provide reductions for bundled providers like house and renters insurance coverage. | Premiums usually aggressive, typically influenced by particular person elements. |

| Allstate | Affords a broad spectrum of protection choices, from primary legal responsibility to complete packages. They typically characteristic on-line instruments for coverage administration and comparisons. | Premiums usually in step with market averages, with variations based mostly on driver profiles and car varieties. |

| Geico | Identified for aggressive premiums, particularly for younger drivers. Their protection choices often embrace legal responsibility, collision, and complete safety. | Premiums are sometimes decrease than different main suppliers, significantly for drivers with good information. |

This desk gives a common comparability. Precise premiums will fluctuate considerably based mostly on particular person circumstances, akin to driving historical past, car sort, and protection picks.

Discovering Low cost Automotive Insurance coverage

Securing inexpensive automobile insurance coverage in Fort Myers includes strategic analysis and proactive comparability. Understanding the out there choices and reductions can considerably scale back your premiums. This part particulars key methods for locating probably the most aggressive charges.

Methods for Discovering Reasonably priced Automotive Insurance coverage

Discovering inexpensive automobile insurance coverage requires a proactive strategy. Researching completely different suppliers and using comparability instruments are essential steps on this course of. Evaluating your present protection wants and exploring out there reductions are additionally important elements of securing a positive insurance coverage price.

On-line Comparability Instruments

Quite a few on-line platforms facilitate the comparability of assorted automobile insurance coverage quotes. These instruments usually collect quotes from a number of insurers, permitting you to rapidly consider completely different choices. This streamlined strategy saves vital effort and time, enabling you to decide on the absolute best protection. Utilizing comparability instruments successfully is a helpful technique for locating probably the most aggressive insurance coverage charges.

In style comparability websites typically present detailed data on completely different insurance policies and insurers, permitting you to make knowledgeable choices.

Obtainable Insurance coverage Reductions

A number of reductions are steadily out there to Fort Myers residents. These reductions can considerably decrease insurance coverage premiums, making automobile insurance coverage extra inexpensive. Understanding and leveraging these reductions is vital to minimizing your general insurance coverage prices.

Desk of Insurance coverage Reductions

| Low cost Kind | Description | Eligibility |

|---|---|---|

| Good Pupil Low cost | Lowered premiums for drivers with an excellent tutorial document. | Enrolled in a highschool or faculty program and preserve a minimal GPA. |

| Multi-Automotive Low cost | Lowered premiums for people insuring a number of automobiles with the identical insurer. | Proudly owning two or extra automobiles insured underneath the identical coverage. |

| Defensive Driving Course Low cost | Lowered premiums for finishing a defensive driving course. | Completion of an accredited defensive driving course. |

| Bundling Low cost | Lowered premiums for combining a number of insurance coverage merchandise (e.g., automobile, house, renters). | Insuring a number of merchandise (automobile, house, renters) with the identical supplier. |

| Protected Driver Low cost | Lowered premiums for drivers with a clear driving document. | Sustaining a clear driving document with out vital accidents or violations. |

Components Affecting Fort Myers Automotive Insurance coverage Prices

Securing inexpensive automobile insurance coverage in Fort Myers, like some other location, hinges on understanding the important thing elements that affect premiums. These elements, ranging out of your driving document to your car’s traits, all play a vital function in figuring out the price of your coverage. By understanding these influences, you possibly can proactively take steps to doubtlessly decrease your insurance coverage charges.

Driving Report Impression

A clear driving document is paramount in securing favorable automobile insurance coverage charges. A historical past of accidents, site visitors violations, and even dashing tickets considerably will increase your insurance coverage premium. Insurance coverage firms assess threat based mostly on driving historical past, and a constructive document displays a decrease threat profile, resulting in decrease premiums. For instance, a driver with a historical past of at-fault accidents will seemingly pay a considerably increased premium in comparison with a driver with a clear document.

Automobile Kind Affect

The kind of car you drive is one other key think about figuring out your automobile insurance coverage premium. Sure automobiles, significantly these recognized for increased accident threat or increased restore prices, appeal to increased insurance coverage premiums. Sports activities vehicles, luxurious automobiles, and high-performance vehicles typically include elevated premiums resulting from their typically increased restore prices and potential for extra extreme harm.

Conversely, extra economical automobiles usually have decrease insurance coverage premiums.

Location-Particular Premiums

Location inside Fort Myers can even affect your automobile insurance coverage prices. Areas with increased crime charges or increased accident densities typically have increased insurance coverage premiums. It’s because insurance coverage firms issue within the threat of theft, vandalism, or accidents inside a selected space. Insurance coverage firms use statistical knowledge to evaluate the chance related to specific areas.

Age and Gender Issues

Age and gender are additionally thought of in figuring out insurance coverage premiums, although these elements are sometimes much less influential than driving document or car sort. Youthful drivers, statistically, are likely to have increased accident charges, resulting in increased premiums. Equally, gender-based variations in driving habits, whereas not as vital as different elements, can nonetheless affect premiums to a small diploma.

Automobile Kind Premium Comparability

| Automobile Kind | Premium Vary (Illustrative Instance – Precise Premiums Fluctuate Based mostly on Particular Components) |

|---|---|

| Financial system Sedan | $1,000 – $1,500 per yr |

| Sports activities Automotive | $1,500 – $2,500 per yr |

| Luxurious SUV | $1,800 – $2,800 per yr |

| Excessive-Efficiency Sports activities Automotive | $2,000 – $3,500 per yr |

| Compact Truck | $1,200 – $1,800 per yr |

Be aware: These are illustrative examples solely. Precise premiums will fluctuate considerably based mostly on particular person driving information, areas, and different elements like deductibles and add-ons.

Suggestions for Decreasing Fort Myers Automotive Insurance coverage Prices

Securing inexpensive automobile insurance coverage in Fort Myers, like some other location, requires proactive measures and knowledgeable decisions. Understanding the elements that affect premiums and implementing methods to mitigate these elements can considerably scale back your insurance coverage prices. By using the following tips, you possibly can obtain larger monetary management over your automobile insurance coverage bills.Efficient methods for reducing Fort Myers automobile insurance coverage prices contain understanding the elements influencing your premiums and implementing proactive measures.

This contains sustaining a clear driving document, deciding on acceptable protection, and exploring alternatives for bundling insurance coverage merchandise. These methods can result in substantial financial savings in the long term.

Sustaining a Good Driving Report

A clear driving document is a cornerstone of acquiring inexpensive automobile insurance coverage. Constant secure driving practices, together with adherence to site visitors legal guidelines and avoiding accidents, are paramount to sustaining a positive driving document. This, in flip, results in decrease premiums.

- Keep away from dashing tickets and site visitors violations. Even minor infractions can enhance your insurance coverage premiums.

- Prioritize defensive driving methods. Staying alert, sustaining a secure following distance, and anticipating potential hazards can considerably scale back the chance of accidents.

- Report all accidents promptly to your insurance coverage firm. Failure to take action may end up in penalties and elevated premiums.

- Take a defensive driving course. These programs can present helpful expertise and data, resulting in improved driving habits and a decrease threat of accidents.

Selecting the Proper Protection Choices

Cautious number of protection choices is essential for balancing safety with affordability. Understanding your wants and choosing the suitable degree of protection can result in substantial financial savings with out compromising security.

- Consider your particular wants. Contemplate your belongings, liabilities, and life-style when figuring out the optimum protection ranges on your car.

- Examine complete and collision protection. Assess the prices and advantages of every possibility based mostly in your particular circumstances and potential dangers.

- Contemplate uninsured/underinsured motorist protection. This protection protects you for those who’re concerned in an accident with a driver who lacks enough insurance coverage.

- Discover liability-only protection. This feature gives the minimal protection required by legislation however could not absolutely shield your belongings in case of an accident.

Bundling Insurance coverage Merchandise

Bundling your insurance coverage merchandise, akin to automobile insurance coverage with house insurance coverage, can typically lead to vital financial savings. Insurance coverage firms steadily provide reductions to clients who mix a number of insurance policies.

- Inquire about reductions for bundling. Many insurance coverage suppliers provide reductions for purchasers who mix a number of insurance coverage merchandise, akin to automobile and residential insurance coverage.

- Store round for bundled insurance coverage offers. Examine presents from completely different insurance coverage suppliers to search out the perfect bundled insurance coverage package deal on your wants.

- Contemplate the advantages and downsides of bundling. Whereas bundling can result in financial savings, it might not at all times be the optimum alternative for each particular person.

Methods to Decrease Fort Myers Automotive Insurance coverage Prices

- Keep a clear driving document. That is the only handiest solution to scale back automobile insurance coverage prices.

- Select acceptable protection choices. Choose solely the protection you want, keep away from pointless add-ons.

- Bundle insurance coverage insurance policies. Mix automobile, house, and different insurance coverage merchandise to doubtlessly obtain reductions.

- Store round for aggressive charges. Examine quotes from completely different insurance coverage suppliers to search out the perfect deal.

- Improve your deductibles. Elevating your deductible can typically result in decrease premiums, however be ready for increased out-of-pocket prices within the occasion of an accident.

- Contemplate a most well-liked driver program. If in case you have a younger driver, discover if a most well-liked driver program can doubtlessly decrease premiums.

Understanding Fort Myers Automotive Insurance coverage Protection

Securing the suitable automobile insurance coverage protection is essential for safeguarding your belongings and monetary well-being in Fort Myers. Understanding the several types of protection out there and their nuances is significant for making knowledgeable choices. This part will element the varied sorts of protection, emphasizing the distinctions between legal responsibility, collision, and complete protection, in addition to uninsured/underinsured motorist safety.Fort Myers, like different areas, has particular insurance coverage necessities.

Understanding your protection choices empowers you to decide on the perfect match on your driving habits and monetary scenario.

Varieties of Automotive Insurance coverage Protection

Understanding the several types of protection out there is crucial for choosing the suitable coverage. Completely different coverages deal with completely different dangers, and the correct mix of protection can considerably influence your premiums. The sorts of protection out there in Fort Myers, as in most states, embrace legal responsibility, collision, complete, and uninsured/underinsured motorist protection.

Legal responsibility Protection

Legal responsibility protection protects you in case you are at fault in an accident. It covers the opposite social gathering’s damages, together with medical bills and property harm. The quantity of protection you choose will decide the extent of your monetary duty. For instance, a coverage with $100,000 in legal responsibility protection might pay as much as that quantity to compensate the injured social gathering, do you have to be discovered liable.

Be aware that there are sometimes minimal legal responsibility necessities set by state legislation.

Collision Protection

Collision protection protects your car if it is broken in an accident, no matter who’s at fault. This protection pays for repairs or substitute of your automobile. It is essential if you wish to guarantee your car is repaired or changed even when the accident is your fault.

Complete Protection

Complete protection protects your car in opposition to non-collision damages, akin to vandalism, hearth, theft, hail, or weather-related harm. It is a helpful addition to your coverage, because it gives safety in opposition to unexpected occasions that would considerably influence your car.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection gives safety in case you are concerned in an accident with a driver who would not have insurance coverage or would not have sufficient insurance coverage to cowl the damages. This protection is crucial, because it safeguards you from monetary loss in such conditions.

Protection Comparability Desk

| Protection Kind | Description | Significance |

|---|---|---|

| Legal responsibility | Covers damages to others in an accident the place you’re at fault. | Important for authorized safety and monetary duty. |

| Collision | Covers harm to your car in an accident, no matter who’s at fault. | Protects your funding in your car. |

| Complete | Covers harm to your car from occasions aside from collisions, akin to vandalism, hearth, or theft. | Gives safety in opposition to sudden and infrequently expensive damages. |

| Uninsured/Underinsured Motorist | Covers damages in case you are in an accident with an uninsured or underinsured driver. | Essential for monetary safety in accidents involving negligent drivers. |

Native Insurance coverage Brokers in Fort Myers: Low cost Automotive Insurance coverage Fort Myers

Discovering the suitable automobile insurance coverage in Fort Myers can really feel overwhelming. Native insurance coverage brokers present a helpful useful resource, providing customized steering and knowledgeable recommendation tailor-made to your particular wants and circumstances. They act as a bridge between you and the advanced world of insurance coverage insurance policies, serving to you navigate the varied choices and make sure you’re adequately protected.

The Function of Native Brokers

Native insurance coverage brokers in Fort Myers are extra than simply salespeople. They’re trusted advisors who perceive the distinctive wants of drivers within the space. They possess in-depth data of native site visitors patterns, widespread accident hotspots, and the particular insurance coverage rules that have an effect on Fort Myers residents. This native experience permits them to suggest tailor-made insurance policies that supply optimum protection at aggressive charges.

Their understanding of the world’s specific insurance coverage panorama is essential in securing probably the most advantageous phrases for his or her shoppers.

Discovering Respected Brokers

Quite a few respected insurance coverage brokers function in Fort Myers. A superb start line is to ask for referrals from buddies, household, or colleagues who’ve had constructive experiences with native brokers. On-line sources, akin to on-line directories and evaluation platforms, can even present helpful insights into agent reputations and specializations. Verifying an agent’s licensing and insurance coverage credentials with the state’s Division of Insurance coverage is crucial to make sure legitimacy and reliability.

Search for brokers who’re lively members {of professional} organizations, as this typically signifies a dedication to moral practices and staying up to date on trade developments.

How Brokers Assist Navigate Choices

Insurance coverage brokers in Fort Myers can successfully information shoppers via the method of choosing acceptable protection. They might help assess your particular wants, contemplating elements akin to your driving historical past, car sort, and desired protection ranges. This evaluation permits them to current a wide range of coverage choices, clearly explaining the advantages and downsides of every. Moreover, brokers can evaluate quotes from completely different insurance coverage firms, serving to you discover the absolute best charges whereas sustaining the required protection.

They will additionally clarify advanced coverage language, making certain you perceive the phrases and situations earlier than committing to a coverage.

Examples of Agent Help

Think about needing extra protection for a high-value car or a younger driver with a restricted driving document. An agent can tailor a coverage that features complete protection choices and doubtlessly decrease premiums by figuring out out there reductions for secure driving or good scholar standing. Within the case of a enterprise proprietor needing protection for his or her firm automobiles, an agent can recommend specialised business auto insurance coverage insurance policies.

This customized strategy ensures the shopper’s distinctive necessities are met, leading to the simplest and cost-effective protection.

Contact Data for Native Brokers

| Agent Identify | Contact Data | Specializations |

|---|---|---|

| ABC Insurance coverage | (555) 123-4567, abc@e mail.com | Auto, Residence, Life |

| XYZ Insurance coverage Companies | (555) 987-6543, xyz@e mail.com | Industrial Auto, Bike, Boat |

| Insurance coverage Options | (555) 555-1212, insurance coverage@e mail.com | Younger Drivers, Excessive-Worth Autos, Enterprise Homeowners |

Latest Traits in Fort Myers Automotive Insurance coverage

Latest years have witnessed dynamic shifts within the Fort Myers automobile insurance coverage market, pushed by technological developments and evolving shopper conduct. Understanding these developments is essential for each shoppers in search of inexpensive protection and insurance coverage suppliers adapting to altering circumstances. This part explores the important thing developments impacting automobile insurance coverage charges within the space.

Expertise’s Impression on Insurance coverage Charges

Technological developments are considerably influencing automobile insurance coverage pricing fashions. The rise of telematics, related automobile applied sciences, and superior driver-assistance methods (ADAS) is altering how insurers assess threat. Insurers are more and more using knowledge from these applied sciences to supply customized and extra correct threat assessments.

Changes to Market Modifications by Insurance coverage Corporations

Insurance coverage firms in Fort Myers are responding to the altering market dynamics by implementing varied methods. As an example, some firms are providing tailor-made reductions to drivers using telematics packages. Moreover, insurers are implementing new pricing fashions that incorporate real-time driving knowledge to create extra exact threat profiles. This strategy permits for extra focused premium changes, benefiting each drivers and the businesses.

Comparability of Fort Myers Automotive Insurance coverage Charges (2020-2023)

Analyzing insurance coverage charges from 2020 to 2023 in Fort Myers reveals a noticeable pattern. Whereas particular knowledge factors will not be available, anecdotal proof and trade stories recommend a gradual enhance in premiums over this era. A number of elements, together with rising restore prices and the continuing influence of inflation, seemingly contributed to this enhance. The particular influence on several types of automobiles and driver profiles requires additional evaluation of complete knowledge.

Examples of Technological Improvements

Telematics packages enable insurers to assemble detailed driving knowledge from related automobiles. This knowledge can embody elements akin to driving habits, pace, and braking patterns. By analyzing this data, insurers can assess threat extra precisely, enabling the event of custom-made insurance coverage packages and customized premiums. For instance, a driver demonstrating secure driving habits would possibly qualify for decrease premiums. Conversely, a driver with a historical past of aggressive driving would possibly face increased premiums.

Particular Automotive Insurance coverage Wants for Fort Myers Drivers

Fort Myers, Florida, presents distinctive driving situations and challenges that affect automobile insurance coverage wants. Understanding these nuances is essential for securing acceptable protection. This part particulars the particular insurance coverage necessities tailor-made to the native driving surroundings and highlights potential dangers.

Climate-Associated Dangers

Fort Myers experiences a subtropical local weather, which brings a mixture of sunshine and occasional extreme climate. This presents a selected want for complete protection that addresses potential harm from storms, flooding, and different weather-related incidents. Florida’s hurricane season, which generally runs from June via November, is a significant factor in figuring out insurance coverage necessities. Many drivers within the space discover themselves needing extra protection for potential harm or disruption resulting from tropical storms and hurricanes.

Excessive-Velocity Driving Situations

Fort Myers includes a community of highways and roads, some with high-speed limits. This could enhance the probability of accidents involving excessive speeds and doubtlessly extreme accidents. Drivers in Fort Myers ought to prioritize insurance coverage that embrace enough bodily damage legal responsibility protection to make sure safety in opposition to vital medical bills. Furthermore, complete protection is essential to deal with potential damages to automobiles ensuing from accidents involving high-speed collisions.

Elevated Threat of Accidents in Particular Areas

Sure areas in Fort Myers could current heightened accident dangers resulting from elements like site visitors congestion or building. Drivers ought to fastidiously consider the chance elements in particular areas the place they steadily drive and search insurance coverage protection that displays these situations. Researching native accident statistics in these areas might help drivers decide the necessity for added protection or increased legal responsibility limits.

Particular areas could require supplementary protection to deal with the elevated potential for collisions.

Often Requested Questions on Fort Myers Automotive Insurance coverage

- What sorts of protection are essential for Fort Myers drivers? Complete protection is crucial to deal with potential harm from storms, flooding, or different weather-related occasions. Legal responsibility protection is equally crucial to guard in opposition to the monetary repercussions of accidents. Contemplate extra uninsured/underinsured motorist protection to mitigate dangers related to drivers missing enough insurance coverage.

- How does the hurricane season influence Fort Myers automobile insurance coverage? The hurricane season necessitates extra consideration for complete protection. Insurance coverage suppliers usually regulate premiums and protection choices throughout this era. Drivers ought to inquire about particular hurricane-related insurance policies or extra protection choices.

- Are there any particular driving situations that enhance accident dangers in Fort Myers? Excessive-speed driving and doubtlessly hazardous climate situations, akin to flooding, can considerably enhance the probability of accidents. These elements necessitate complete protection and doubtlessly increased legal responsibility limits.

- What steps can drivers take to cut back their automobile insurance coverage premiums in Fort Myers? Sustaining a clear driving document, using defensive driving programs, and sustaining an excellent credit score historical past might help decrease insurance coverage premiums. Drivers ought to analysis and evaluate varied insurance coverage choices out there within the space.

Final Phrase

In conclusion, securing low-cost automobile insurance coverage in Fort Myers requires a proactive strategy. By understanding the market, evaluating choices, and contemplating varied elements like driving document and car sort, you possibly can considerably scale back your insurance coverage premiums. This information gives a roadmap to navigate the method, serving to you discover the perfect protection on your wants. Bear in mind to think about native developments and search skilled recommendation when obligatory.

In the end, knowledgeable decision-making will result in probably the most inexpensive and appropriate automobile insurance coverage on your scenario in Fort Myers.

Clarifying Questions

What are widespread reductions out there for automobile insurance coverage in Fort Myers?

Many firms provide reductions for good scholar standing, a number of automobiles, and secure driving information. Examine with particular person insurers for particular particulars and eligibility standards.

How does my location inside Fort Myers have an effect on my insurance coverage premiums?

Sure areas inside Fort Myers could have increased accident charges or particular security issues that influence insurance coverage premiums. It is value checking your particular deal with for any potential variations in pricing.

What sorts of automobile insurance coverage protection can be found in Fort Myers?

Customary protection choices embrace legal responsibility, collision, and complete. Understanding these varieties and their variations is crucial to deciding on the suitable safety on your wants.

How can I discover respected insurance coverage brokers in Fort Myers?

Search for brokers with robust neighborhood ties, constructive on-line critiques, and licenses from the Florida Division of Monetary Companies. Networking with family and friends for suggestions will also be useful.