Automotive insurance coverage for retired academics? Completely! Navigating the world of insurance coverage as a retiree could be tough, however this information breaks it down. We’ll cowl every part from the precise wants of retired academics to cost-saving methods and totally different insurance coverage supplier choices. Get able to stage up your retirement recreation, peeps!

This complete information dives into the intricacies of automobile insurance coverage for retired academics, highlighting their distinctive wants and circumstances. From understanding protection choices to evaluating insurance coverage suppliers, we have got you lined. It is all about ensuring you are financially protected as you embrace this new chapter!

Protection Wants of Retired Academics

Retirement marks a major shift in life-style and monetary priorities. For retired academics, this transition usually brings distinctive insurance coverage wants, distinct from these of working professionals. Understanding these particular necessities is essential for making certain enough safety and peace of thoughts.Retired academics, not like their working counterparts, face a special spectrum of dangers and liabilities. Whereas working professionals are sometimes lined by employer-sponsored insurance coverage, retirees are solely chargeable for their very own safety.

This independence necessitates cautious consideration of assorted protection choices to mitigate potential monetary burdens.

Typical Insurance coverage Wants

Retired academics usually prioritize complete protection that addresses the potential monetary ramifications of unexpected occasions. Legal responsibility protection is paramount, as retirees might face incidents involving property injury or private damage. Medical funds protection can be very important to deal with potential medical bills arising from accidents or diseases. Uninsured/underinsured motorist protection offers a security internet in opposition to incidents involving drivers with out enough insurance coverage.

Moreover, householders or renters insurance coverage, relying on the housing state of affairs, can be a important consideration to guard property.

Potential Dangers and Liabilities

Retired academics, particularly these concerned in energetic existence, might face the next probability of accidents in comparison with those that lead a extra sedentary life-style. Potential dangers embrace slips, journeys, and falls, particularly if they’re concerned in hobbies or actions like gardening, mountaineering, or volunteering. Internet hosting friends or collaborating in social actions can even introduce legal responsibility considerations. Moreover, the rising prevalence of well being circumstances amongst retirees necessitates enough medical insurance protection.

The price of long-term care is one other vital concern.

Protection Choices for Totally different Life

| Life-style | Precedence Coverages | Particular Concerns |

|---|---|---|

| Lively Retirees | Legal responsibility, medical funds, uninsured/underinsured motorist, and doubtlessly supplemental medical insurance. | Greater probability of accidents necessitates sturdy protection, together with complete legal responsibility safety. Lively retirees usually take part in hobbies and actions that improve their publicity to danger. |

| Retirees with Pre-existing Well being Situations | Complete medical insurance, long-term care insurance coverage, and supplemental medical funds protection. | Greater medical bills are a significant concern. Lengthy-term care insurance coverage is essential to mitigate potential monetary burdens associated to assisted dwelling or nursing house care. |

| Retirees with Restricted Earnings | Legal responsibility, medical funds, uninsured/underinsured motorist, and doubtlessly decrease premiums on protection. | Monetary limitations might necessitate cautious collection of reasonably priced however complete protection choices. Reviewing choices with an insurance coverage skilled is important. |

Value Concerns for Retired Academics

Navigating the monetary panorama of retirement could be tough, and automobile insurance coverage prices aren’t any exception. Understanding the components that affect premiums and the methods to maintain them manageable is essential to sustaining monetary safety. This part dives into cost-saving techniques and the typical premiums for numerous insurance policies focused at retired academics.

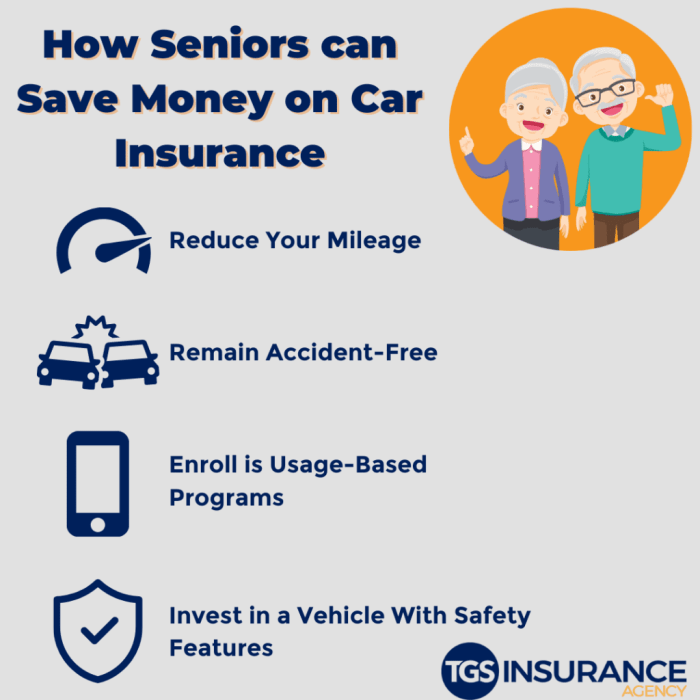

Frequent Value-Saving Methods

Quite a few methods may help retirees, together with academics, cut back their automobile insurance coverage prices. Prioritizing protected driving habits is a cornerstone of efficient value administration. Sustaining a clear driving report and avoiding accidents or visitors violations are essential steps to securing decrease premiums. Common car upkeep performs a major position in stopping pricey repairs that would influence premiums.

- Protected Driving Practices: Adhering to visitors legal guidelines, avoiding dangerous maneuvers, and working towards defensive driving considerably cut back the danger of accidents, resulting in decrease insurance coverage premiums.

- Car Upkeep: Common servicing, together with oil adjustments and tire rotations, may help prolong the lifetime of your car, decreasing the probability of pricey repairs and related insurance coverage implications.

- Bundling Insurance coverage Insurance policies: Combining a number of insurance coverage insurance policies, comparable to house and auto insurance coverage, with the identical supplier can usually result in bundled reductions, providing substantial financial savings.

- Reductions for Retired People: Some insurance coverage suppliers provide particular reductions for retired people. You will need to inquire about such reductions to doubtlessly lower your expenses.

Reductions and Promotions for Retired People

Insurance coverage corporations ceaselessly provide reductions to particular demographics, together with retired people. These reductions can range considerably, providing a substantial value benefit for retirees. Some examples of reductions embrace senior citizen reductions and reductions for protected driving habits.

- Senior Reductions: Many insurers present reductions particularly for senior residents, recognizing the diminished danger related to their driving expertise.

- Protected Driving Reductions: Insurance coverage suppliers ceaselessly reward protected driving habits with reductions, additional incentivizing accident avoidance.

- Bundling Reductions: Combining a number of insurance coverage insurance policies, like auto, house, and life insurance coverage, usually results in vital financial savings, decreasing the general value for the policyholder.

- Reductions for Particular Car Options: Some insurers provide reductions for autos with particular security options, comparable to anti-theft gadgets or superior airbags.

Common Premiums for Varied Insurance policies

The typical premiums for automobile insurance coverage insurance policies concentrating on retired academics can fluctuate considerably relying on a number of components. These components embrace the kind of car, the driving force’s historical past, and the precise protection choices chosen. For example, a costlier car or one with the next danger profile, comparable to a sports activities automobile, might have the next premium.

- Primary Legal responsibility Protection: Insurance policies with solely fundamental legal responsibility protection normally have the bottom premiums, providing a baseline of safety. Nevertheless, this protection won’t adequately shield the driving force’s monetary well-being within the occasion of an accident.

- Complete Protection: Complete protection offers safety in opposition to a broader vary of potential damages, together with vandalism, hail, and different unexpected occasions. Premiums for complete protection are sometimes increased than fundamental legal responsibility protection, providing extra complete safety.

- Collision Protection: Collision protection safeguards in opposition to damages to the insured car ensuing from collisions. The premiums for collision protection could be influenced by the car’s worth and the driving force’s danger profile.

Comparability of Insurance coverage Suppliers and Prices

This desk illustrates the varied pricing methods adopted by numerous insurance coverage suppliers for retired academics, highlighting the vary of prices for related insurance policies.

| Insurance coverage Supplier | Primary Legal responsibility | Complete | Collision |

|---|---|---|---|

| Firm A | $800 | $1,200 | $900 |

| Firm B | $950 | $1,100 | $1,050 |

| Firm C | $750 | $1,000 | $850 |

| Firm D | $850 | $1,150 | $950 |

Particular Necessities and Rules

Retirement usually brings a shift in life-style, together with driving habits. Understanding how these adjustments have an effect on automobile insurance coverage is essential for retired academics, making certain they’ve the fitting protection on the best value. This part delves into the specifics of age-related components, regional rules, driving historical past, and well being concerns that affect automobile insurance coverage premiums for this demographic.

Affect of Age on Automotive Insurance coverage Premiums and Protection

Age performs a major position in figuring out automobile insurance coverage charges. Usually, insurers take into account older drivers as the next danger class, usually resulting in increased premiums. It is because insurers assess potential accident dangers, declare frequency, and medical circumstances based mostly on age. For instance, older drivers may need diminished response instances, doubtlessly rising the probability of accidents. Nevertheless, this is not universally true.

Many retired academics have maintained wonderful driving data all through their lives, and their age does not essentially equate to increased danger. Insurers ceaselessly analyze claims knowledge and driving patterns to regulate their danger assessments. Insurance coverage corporations use actuarial tables to find out the anticipated value of claims for numerous age teams. This evaluation permits them to set charges that mirror the anticipated monetary burden of insuring drivers inside particular age brackets.

Potential Rules Affecting Automotive Insurance coverage for Retired Academics

Varied rules and legal guidelines affect automobile insurance coverage practices in several areas. These can range based mostly on state or province-specific rules, affecting the kinds of protection accessible, premium constructions, and the required minimal protection limits. For example, some areas may need legal guidelines that require a selected stage of legal responsibility protection, whereas others may provide extra complete choices. It’s essential for retired academics to pay attention to these rules of their respective areas to make sure compliance and applicable protection.

These rules additionally may embrace stipulations concerning the kinds of autos which might be insurable.

Position of Driving Historical past and Expertise in Figuring out Premiums

A driver’s previous driving report is a major consider figuring out insurance coverage premiums. A clear driving historical past with no accidents or violations sometimes interprets to decrease premiums. Conversely, accidents or visitors violations can result in increased premiums because of the elevated danger related to such incidents. Retired academics, like different drivers, are topic to those ranking standards.

For example, a retired instructor with a protracted historical past of protected driving, doubtlessly even many years, may qualify for reductions, whereas one with a historical past of accidents may need to pay the next premium. Insurers usually use quite a lot of components of their evaluation, such because the variety of accidents, the severity of the accidents, and the frequency of violations.

Implications of Medical Situations or Well being Components on Insurance coverage Charges

Medical circumstances and well being components can even affect automobile insurance coverage charges. Insurers might take into account components like pre-existing circumstances, latest medical procedures, or any documented well being points that would have an effect on driving capacity. For example, a retired instructor with a documented medical situation, like a imaginative and prescient impairment or a power well being problem which may have an effect on their response time, may face increased premiums.

Insurers use numerous strategies to evaluate these dangers, comparable to evaluating medical data or requiring medical examinations to gauge the influence of well being circumstances on driving capacity. In such circumstances, disclosing related medical info to the insurance coverage supplier is important to make sure probably the most correct danger evaluation.

Evaluating Insurance coverage Suppliers

Navigating the panorama of automobile insurance coverage choices can really feel overwhelming, particularly while you’re a retired instructor with particular wants. Understanding how totally different suppliers cater to the distinctive circumstances of retirees, like driving habits and monetary conditions, is essential for securing the fitting protection at the very best value. This part delves into the comparative strengths and weaknesses of assorted insurance coverage corporations for retired academics, offering a transparent image of how totally different plans deal with particular person necessities.Insurance coverage suppliers acknowledge that retired academics, as a demographic, usually have distinct traits that influence their danger profiles.

This understanding is important for tailoring insurance policies to satisfy the precise wants of this group, encompassing components comparable to decrease mileage, safer driving data, and doubtlessly decrease revenue. Consequently, some corporations may provide specialised reductions or options aimed toward this demographic.

Insurance coverage Firm Strengths and Weaknesses, Automotive insurance coverage for retired academics

Totally different insurance coverage corporations possess various strengths and weaknesses, which immediately have an effect on their suitability for retired academics. Some corporations excel in offering complete protection at aggressive charges, whereas others is perhaps higher at dealing with claims effectively. A cautious analysis of those components is important to search out the optimum supplier.

Comparative Evaluation of Insurance coverage Plans

| Insurance coverage Firm | Strengths | Weaknesses | Particular Advantages for Retired Academics |

|---|---|---|---|

| Firm A | Identified for aggressive charges and intensive protection choices, particularly for lower-mileage drivers. Usually offers reductions for protected driving data. | Might have barely longer declare processing instances in comparison with some rivals. | Gives a specialised “Retired Trainer Plan” with bundled reductions on roadside help and rental automobile protection. |

| Firm B | Glorious repute for fast and environment friendly claims dealing with, usually praised for his or her customer support. Supplies numerous add-on choices for complete protection. | Premiums is perhaps barely increased than Firm A, however that is usually offset by the velocity of claims processing. | Supplies a “Senior Driver” low cost, particularly concentrating on retired people. |

| Firm C | Focuses on digital platforms and on-line instruments for managing insurance policies and claims. Usually boasts superior danger evaluation fashions that may result in decrease premiums. | Restricted native customer support choices, relying extra on on-line assist. | Gives “Mileage-Primarily based Reductions” that reward low-mileage drivers, which is right for retirees. |

Tailoring Plans to Demographic Wants

Insurance coverage corporations acknowledge the precise wants of various demographics, and retired academics aren’t any exception. That is evident within the numerous reductions and options provided to satisfy the wants of this particular group. The “Senior Driver” reductions, for instance, are designed to mirror the diminished danger profile of retired drivers. Such focused methods permit corporations to supply extra aggressive premiums and higher tailor-made plans.

Claims Dealing with Procedures

The effectivity and effectiveness of claims dealing with procedures range considerably amongst totally different suppliers. Some corporations have a repute for processing claims swiftly and pretty, whereas others could also be slower or extra bureaucratic. Reviewing buyer testimonials and on-line opinions can present insights into the precise experiences of coping with claims. Understanding these procedures will support in making knowledgeable choices about which supplier is probably the most applicable.

Instance of Coverage Tailoring

Take into account a retired instructor with a low-mileage car and a clear driving report. A supplier that focuses on “low-mileage” reductions would seemingly provide a extra aggressive price than a supplier that does not prioritize this issue. This tailor-made method to pricing displays the diminished danger related to low-mileage driving.

Insurance coverage Choices for Retired Academics with Particular Wants

Navigating the world of automobile insurance coverage can really feel like navigating a maze, particularly while you’re a retired instructor with distinctive circumstances. This part delves into tailor-made insurance coverage choices designed to deal with the precise wants of retired educators, specializing in mobility challenges, geographic location, and car security. Understanding the nuances of danger evaluation and the way insurance coverage corporations deal with accidents can be essential.Insurance coverage suppliers provide various choices, acknowledging that every particular person’s wants are distinctive.

A complete method to insurance coverage ought to take into account components just like the car’s upkeep, security options, and the driving force’s age and expertise. This detailed evaluation will illuminate the intricacies of insurance coverage protection for retired academics with explicit wants.

Insurance coverage Choices for Mobility Points

Retired academics with mobility limitations usually require autos tailored to their wants. Insurance coverage suppliers might provide particular protection tailor-made to such conditions. This may embrace modified autos, like these with hand controls or lifts, and will incorporate extra riders or exclusions that cater to the precise necessities.

Insurance coverage Choices for Particular Geographic Areas

Insurance coverage charges can fluctuate considerably based mostly on location. Excessive-risk areas, comparable to these with the next frequency of accidents or difficult driving circumstances, sometimes command increased premiums. Retired academics dwelling in these areas may discover increased premiums for related protection.

Car Upkeep and Security Options

The significance of sustaining a car’s situation can’t be overstated. Insurance coverage corporations usually take into account car upkeep data and security options when assessing danger. A well-maintained car with up to date security options, comparable to airbags or anti-lock brakes, normally ends in a decrease premium. Examples embrace usually scheduled upkeep, up-to-date security gear, and a clear driving report.

Insurance coverage Firm Danger Evaluation of Age Teams

Insurance coverage corporations make the most of actuarial knowledge and statistical fashions to evaluate the danger related to totally different age teams. Older drivers, like retired academics, are sometimes categorized in another way than youthful drivers. Driving expertise, well being circumstances, and up to date accident historical past are components thought of within the evaluation. For instance, an aged driver with a latest accident involving vital accidents could also be positioned in the next danger class, resulting in the next premium.

Dealing with Accidents Involving Totally different Ranges of Negligence

Insurance coverage insurance policies usually Artikel how they deal with accidents involving totally different ranges of negligence. Insurance policies usually classify accidents as both a full, partial, or no-fault accident. The coverage phrases clearly Artikel the tasks and protection for every get together concerned in an accident. Full duty is assigned when one get together is solely at fault. Partial duty may happen when each events are partially at fault.

The particular provisions of the coverage will element the monetary obligations and the extent of protection supplied.

Understanding Coverage Language and Nice Print: Automotive Insurance coverage For Retired Academics

Navigating the world of automobile insurance coverage can really feel like deciphering a fancy code. Understanding the coverage language, particularly for retired academics with distinctive wants, is essential to making sure your protection aligns along with your expectations. A single, seemingly innocuous clause can have vital monetary implications. Subsequently, a meticulous assessment of each element is paramount.Thorough comprehension of coverage language, together with the fantastic print, empowers you to make knowledgeable choices about your protection.

This entails understanding the precise phrases, circumstances, and exclusions inside your coverage doc. This detailed information is important for retirees, as their wants and circumstances may differ from these of youthful drivers. Realizing what’s and is not lined prevents unexpected bills and ensures your protection successfully meets your necessities.

Significance of Cautious Overview

Understanding the nuances of your automobile insurance coverage coverage is paramount. It is not simply concerning the preliminary premium; it is about long-term monetary safety. Fastidiously reviewing your coverage protects you from surprising prices and ensures you are adequately lined for the circumstances you face. A radical assessment helps make sure you perceive the exact limits of your protection.

Frequent Coverage Phrases and Definitions

A exact understanding of widespread coverage phrases is important. Misinterpretations can result in vital monetary burdens.

| Time period | Definition |

|---|---|

| Deductible | The quantity you pay out-of-pocket earlier than your insurance coverage firm begins to pay. |

| Legal responsibility Protection | Protects you from monetary duty in the event you trigger injury or damage to a different particular person or their property. |

| Collision Protection | Pays for injury to your car if it is concerned in an accident, no matter who’s at fault. |

| Complete Protection | Covers injury to your car from occasions apart from collisions, comparable to vandalism, hearth, or theft. |

| Uninsured/Underinsured Motorist Protection | Protects you in the event you’re concerned in an accident with a driver who does not have insurance coverage or does not have sufficient insurance coverage to cowl the damages. |

| Coverage Interval | The particular timeframe for which your insurance coverage coverage is legitimate. |

Understanding Advanced Insurance coverage Coverage Language

Insurance coverage insurance policies usually use technical jargon. Breaking down complicated sentences and searching for clarification out of your insurance coverage supplier is important. Do not hesitate to ask questions on clauses you do not perceive. A transparent understanding of the language is essential to stopping misunderstandings.

Exclusions and Limitations in Insurance policies

Understanding exclusions and limitations is essential. These clauses Artikel what your insurance coverage coverage doesnot* cowl. Exclusions can range broadly, from particular kinds of autos to explicit circumstances. Figuring out these exclusions is important to keep away from pricey surprises. A well-informed resolution about your protection is feasible with cautious assessment of the exclusions and limitations.

Understanding these components helps keep away from unwelcome surprises.

Suggestions and Recommendation for Retired Academics

Navigating the complexities of automobile insurance coverage as a retired instructor can really feel daunting. Understanding your particular wants and proactively managing danger components can considerably influence your premiums. This part offers actionable steps to decrease prices and successfully talk with insurance coverage suppliers.

Lowering Automotive Insurance coverage Prices

Retired academics can take proactive steps to decrease their automobile insurance coverage premiums. These methods are essential for maximizing financial savings and making certain reasonably priced protection.

- Protected Driving Habits: Sustaining a clear driving report is paramount. Keep away from rushing, reckless driving, and visitors violations. Defensive driving methods, comparable to anticipating potential hazards and sustaining protected following distances, contribute considerably to a decrease danger profile. Constant protected driving habits will positively affect insurance coverage charges.

- Car Upkeep: Common car upkeep, together with routine checkups and well timed repairs, prevents potential accidents. Guaranteeing your automobile is in good working order can result in fewer claims and, consequently, decrease premiums. This additionally reduces the possibility of mechanical points that would result in accidents.

- Bundling Insurance coverage: If doable, bundle your automobile insurance coverage with different insurance coverage merchandise, comparable to householders or renters insurance coverage, for potential reductions. This mixed method can yield appreciable financial savings.

- Telematics Units: Think about using telematics gadgets. These gadgets monitor driving habits and reward protected driving with decrease premiums. Many insurance coverage suppliers provide reductions for drivers who reveal protected driving behaviors.

- Overview and Replace Protection: Periodically assessment your present automobile insurance coverage protection. Make sure the protection aligns along with your present wants and circumstances. In case your driving habits or life-style has modified, replace your coverage accordingly.

Managing Danger Components

Proactively managing danger components is essential to reaching cost-effective automobile insurance coverage. This entails understanding your private driving patterns and taking steps to mitigate potential dangers.

- Age and Driving Expertise: Driving expertise and age are important components influencing insurance coverage charges. An extended driving historical past, with a demonstrably protected report, can translate into decrease premiums. The longer you will have been driving with out accidents or violations, the decrease your premiums are prone to be.

- Car Sort and Utilization: The kind of car and its utilization additionally play a task in figuring out your premium. A smaller, much less highly effective car may qualify for a decrease price in comparison with a bigger, extra highly effective one. Understanding how ceaselessly and beneath what circumstances you drive may help you discover extra tailor-made protection choices.

- Driving Habits: Components comparable to location and frequency of driving, time of day and driving circumstances (rural vs. city, day vs. evening) can all have an effect on insurance coverage premiums. Tailoring protection to your private driving patterns can considerably influence your insurance coverage prices.

Speaking with Insurance coverage Suppliers

Efficient communication is important when interacting with insurance coverage suppliers. Clearly outlining your wants and considerations is essential for acquiring probably the most appropriate protection at the very best value.

- Requesting Quotes: Acquire quotes from a number of insurance coverage suppliers. Evaluate protection choices and premiums to establish the very best worth. This can be a essential step in acquiring probably the most reasonably priced protection.

- Expressing Wants: Clearly articulate your particular protection wants, comparable to deductibles, protection limits, and non-obligatory add-ons. This transparency is essential to receiving probably the most applicable coverage.

- Understanding Coverage Language: Take the time to rigorously assessment coverage paperwork. Ask questions if something is unclear or ambiguous. Full understanding of the coverage is important for making knowledgeable choices.

Understanding Insurance coverage Insurance policies

A complete understanding of your insurance coverage coverage is important. It allows you to make knowledgeable choices and handle your protection successfully.

- Coverage Overview: Frequently assessment your insurance coverage coverage to make sure it meets your present wants. Changes is perhaps needed based mostly on adjustments in your driving habits or life-style. A radical assessment will make sure that your protection stays related and up-to-date.

- Deductibles and Limits: Understanding the deductible and protection limits is essential for planning monetary implications. Concentrate on the monetary tasks you will have in the event you incur a declare. This may aid you put together for the monetary implications of an accident.

- Claims Course of: Familiarize your self with the claims course of. Understanding the steps concerned in submitting a declare and the procedures for resolving disputes is important. This ensures you are well-prepared for potential future conditions.

Final Conclusion

So, there you will have it—a whole have a look at automobile insurance coverage for retired academics. We have explored the important elements, from protection choices to value concerns and particular necessities. Now you are armed with the information to make knowledgeable choices about your insurance coverage wants. Joyful driving, academics!

Fast FAQs

What are widespread cost-saving methods for retired academics’ automobile insurance coverage?

Bundling your insurance policies, selecting the next deductible, and evaluating quotes from a number of suppliers are some methods. Additionally, some corporations provide reductions for retired people. Test it out!

How does age have an effect on automobile insurance coverage premiums?

Usually, insurance coverage corporations take into account older drivers as the next danger, doubtlessly resulting in increased premiums. Nevertheless, components like driving historical past and well being play a major position too.

What kinds of protection are essential for retired academics?

Legal responsibility protection is important, defending you from monetary duty in accidents. Medical funds protection can be essential to cowl medical bills for your self and others concerned in an accident. Uninsured/underinsured protection is a should to guard you if the opposite driver is not insured.

Are there reductions accessible for retired academics on automobile insurance coverage?

Sure, many insurance coverage suppliers provide reductions for retired people. It is value checking with totally different corporations to see what reductions they could provide.