Finest automotive insurance coverage for sports activities vehicles is essential for safeguarding your experience and pockets. Sports activities vehicles typically include greater insurance coverage premiums because of components like horsepower and potential for injury. Discovering the proper coverage can prevent critical money, so let’s dive into the important thing components and how one can get the very best deal.

This information breaks down every part it’s good to find out about insurance coverage for high-performance automobiles, from understanding the several types of protection to evaluating charges between insurers and discovering methods to decrease your prices.

Introduction to Sports activities Automotive Insurance coverage

Insuring a sports activities automotive presents distinctive concerns in comparison with insuring a typical car. These high-performance automobiles typically include the next danger profile, impacting insurance coverage premiums. Understanding the components influencing these premiums, together with widespread misconceptions and the kinds of protection usually included, is essential for acquiring the absolute best safety. This data empowers you to make knowledgeable choices when securing insurance coverage to your prized sports activities automotive.Elements influencing sports activities automotive insurance coverage premiums are multifaceted and sometimes intertwined.

The worth of the car, its mannequin, its age, and its horsepower are all key parts. Moreover, the motive force’s historical past, together with driving document and any prior accidents, performs a big position. Geographical location, the place the car is predominantly pushed, may also affect premiums.

Distinctive Insurance coverage Issues for Sports activities Vehicles

Sports activities vehicles are sometimes prized for his or her efficiency, however this efficiency can translate to the next danger of accidents. Their highly effective engines and complex options require specialised insurance coverage insurance policies. The inherent danger related to greater speeds and dealing with traits can affect the premium charges.

Elements Influencing Sports activities Automotive Insurance coverage Premiums

A number of components contribute to the premium price for insuring a sports activities automotive. The car’s make, mannequin, and yr of manufacture play a big position, as do horsepower scores. Excessive-performance fashions usually command greater premiums because of their higher danger potential. A clear driving document and a historical past of accountable driving habits can positively impression premiums, whereas accidents or site visitors violations can result in greater prices.

The driving force’s age and placement of use may also have an effect on premiums. The worth of the automotive can be a key issue. Insurance coverage corporations assess the car’s alternative price and take into account components like its rarity and situation.

Widespread Misconceptions about Sports activities Automotive Insurance coverage

A typical false impression is that sports activities automotive insurance coverage is inherently costlier than normal automotive insurance coverage. Whereas premiums could also be greater than for on a regular basis automobiles, the precise price depends upon a number of particular person components. One other false impression is that complete protection just isn’t essential for sports activities vehicles. That is false. Complete protection protects towards injury from occasions like hail, vandalism, or theft.

A complete coverage is important for preserving the worth and situation of a sports activities automotive.

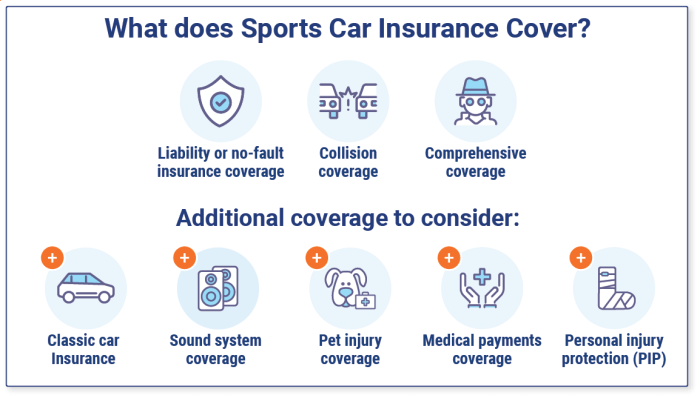

Varieties of Protection Sometimes Included in Sports activities Automotive Insurance coverage Insurance policies

Sports activities automotive insurance coverage insurance policies usually embody legal responsibility protection, which protects towards monetary accountability within the occasion of an accident. Collision protection protects the car towards injury in an accident, no matter fault. Complete protection protects towards injury from occasions past accidents, similar to vandalism, theft, or pure disasters. Uninsured/underinsured motorist protection supplies monetary safety if the opposite driver concerned in an accident lacks insurance coverage or has inadequate protection.

That is essential in safeguarding your pursuits in such situations.

Common Premiums for Completely different Varieties of Sports activities Vehicles

| Sports activities Automotive Mannequin | Estimated Common Premium (Annual) |

|---|---|

| Porsche 911 (2023) | $2,500 – $4,000 |

| Lamborghini Huracán (2022) | $3,500 – $6,000 |

| Ferrari 812 Superfast (2020) | $4,500 – $8,000 |

| McLaren 720S (2019) | $3,000 – $5,500 |

| BMW M3 (2022) | $1,800 – $3,500 |

Word: These are estimated averages and precise premiums will range primarily based on particular person components similar to location, driving historical past, and deductible selections. Premiums are influenced by the precise options and traits of the mannequin.

Elements Affecting Sports activities Automotive Insurance coverage Prices

Securing the proper insurance coverage to your prized sports activities automotive entails understanding the components that affect its price. Insurance coverage corporations rigorously assess varied elements of the car and the motive force to find out acceptable protection ranges and premiums. This analysis course of is designed to steadiness the wants of each the policyholder and the insurance coverage supplier.Understanding these components empowers you to make knowledgeable choices when buying insurance coverage to your sports activities automotive, permitting you to decide on essentially the most appropriate protection choices at a aggressive worth.

Car Options and Insurance coverage Premiums

Car options play a big position in figuring out insurance coverage prices. The horsepower, engine kind, and total efficiency capabilities of a sports activities automotive are key concerns. Increased horsepower scores typically correlate with greater premiums, as these automobiles pose a higher danger in accidents. Furthermore, the kind of engine, similar to a high-performance engine, is commonly seen as rising the potential for injury or expensive repairs, impacting insurance coverage premiums accordingly.

Driver Historical past and Expertise

A driver’s driving historical past and expertise are essential components. Insurers analyze a driver’s previous driving document, together with any accidents, site visitors violations, or claims historical past. A clear driving document and intensive driving expertise typically end in decrease premiums. Conversely, drivers with a historical past of incidents or violations are more likely to face greater premiums. This evaluation displays the insurer’s danger analysis of the motive force’s conduct and driving expertise.

Comparability of Insurance coverage Charges for Completely different Sports activities Automotive Fashions

Insurance coverage charges range significantly throughout totally different sports activities automotive fashions. The particular options and efficiency traits of every mannequin affect the premiums. Elements similar to horsepower, security options, and total design impression the chance evaluation by insurers. Consequently, insurance coverage premiums for a high-performance sports activities automotive with a repute for pace and potential danger could also be greater in comparison with a sports activities automotive with a give attention to dealing with and security.

The repute and market worth of the precise mannequin are additionally essential concerns.

Affect of Modifications on Insurance coverage

Modifications to a sports activities automotive considerably impression insurance coverage premiums. Efficiency enhancements, similar to putting in a extra highly effective engine or upgraded exhaust methods, typically enhance the chance evaluation and result in greater premiums. These modifications can dramatically alter the car’s efficiency traits, doubtlessly rising the chance of harm or accidents, justifying greater premiums. Conversely, modifications that improve security options, like upgraded brakes or dealing with enhancements, may result in decrease premiums.

Desk of Widespread Car Options Influencing Insurance coverage Prices

| Car Characteristic | Affect on Insurance coverage Prices |

|---|---|

| Horsepower | Increased horsepower typically correlates with greater premiums. |

| Engine Kind | Excessive-performance engines typically result in greater premiums. |

| Security Options | Superior security options (e.g., airbags, anti-lock brakes) could result in decrease premiums. |

| Car Age | Older automobiles could have greater premiums because of elevated danger of mechanical points. |

| Modifications | Efficiency modifications typically end in greater premiums, whereas security enhancements may scale back them. |

Evaluating Insurance coverage Suppliers for Sports activities Vehicles

Securing the proper insurance coverage protection to your high-performance car is essential. Choosing the proper supplier to your sports activities automotive entails cautious consideration of assorted components, together with their particular method to dealing with high-performance automobiles, protection choices, and customer support. This part delves into evaluating respected insurance coverage suppliers specializing in sports activities vehicles, providing priceless insights into their distinctive choices and potential advantages.

Respected Insurance coverage Suppliers for Excessive-Efficiency Automobiles

Discovering a supplier specializing in high-performance automobiles is important. These suppliers typically have a deep understanding of the distinctive dangers and concerns related to sports activities vehicles, which may result in extra tailor-made and aggressive insurance coverage options. This experience is essential for precisely assessing the dangers and providing acceptable protection. Some notable examples embody insurers identified for dealing with high-performance automobiles.

These corporations usually possess a specialised workforce adept at evaluating the dangers and offering aggressive premiums.

Insurance coverage Supplier Approaches to Sports activities Automotive Insurance coverage

Completely different insurance coverage suppliers make use of various methods when assessing sports activities automotive insurance coverage wants. Some suppliers may supply specialised packages designed for high-performance automobiles, whereas others may incorporate sports activities vehicles into their current insurance policies with modified phrases. Some suppliers have specialised packages for high-performance automobiles, which generally take into account components like car worth, horsepower, and previous claims historical past. Others could combine sports activities automotive insurance coverage into current insurance policies, though their premiums could be greater or adjusted primarily based on the car’s traits.

Professionals and Cons of Completely different Suppliers

Evaluating the benefits and downsides of assorted insurance coverage suppliers is significant. Some suppliers may supply aggressive premiums for high-performance automobiles, however could have limitations in particular protection choices. Conversely, suppliers with extra intensive protection choices may cost greater premiums. It is also essential to think about the customer support facet; some corporations could have extra environment friendly declare dealing with procedures.

Protection Choices and Deductibles, Finest automotive insurance coverage for sports activities vehicles

Insurance coverage suppliers supply varied protection choices, together with complete, collision, and legal responsibility protection. The particular protection and deductible choices can differ considerably amongst suppliers. Evaluating the precise protection limits, exclusions, and deductibles supplied by varied suppliers is essential to make sure satisfactory safety. The deductibles supplied can range, and selecting a supplier with an acceptable deductible is important.

Buyer Service Experiences

Customer support performs a big position within the insurance coverage expertise. Suppliers with a repute for glorious customer support can ease the method of dealing with claims or addressing coverage questions. Assessing customer support critiques and testimonials can supply insights into the expertise of previous shoppers. Critiques and testimonials from previous shoppers can present priceless insights into the extent of assist supplied.

Comparability Desk of Insurance coverage Suppliers for Sports activities Vehicles

| Insurance coverage Supplier | Strategy to Sports activities Vehicles | Protection Choices | Deductibles | Buyer Service | Premium Estimate (Instance) |

|---|---|---|---|---|---|

| Firm A | Specialised sports activities automotive packages | Complete, Collision, Legal responsibility | $500, $1000 | Excessive scores, fast declare processing | $1,500/yr |

| Firm B | Built-in into current insurance policies | Complete, Collision, Legal responsibility | $1,000, $2,000 | Common scores, reasonable declare processing | $1,200/yr |

| Firm C | Specialised high-performance car division | Complete, Collision, Uninsured Motorist | $500, $1,500 | Wonderful scores, devoted sports activities automotive specialists | $1,800/yr |

Understanding Completely different Protection Choices

Choosing the proper insurance coverage protection to your sports activities automotive is essential for safeguarding your funding and peace of thoughts. Correct protection protects you from monetary burdens within the occasion of accidents or injury. Understanding the totally different choices obtainable lets you make knowledgeable choices, guaranteeing a complete security internet to your prized car.

Complete Protection

Complete protection is important for sports activities vehicles, providing safety towards a variety of perils past collisions. The sort of protection safeguards your car from incidents like vandalism, theft, hail injury, hearth, and weather-related occasions. A sports activities automotive, typically a extra specialised and priceless mannequin, may be significantly weak to those incidents. Complete protection supplies an important monetary buffer towards sudden and sometimes expensive damages.

Collision Protection

Collision protection is designed to guard your sports activities automotive within the occasion of a collision, no matter who’s at fault. This protection pays for the restore or alternative of your car’s injury, thus minimizing monetary accountability to your half in an accident. For prime-value sports activities vehicles, collision protection is especially vital, guaranteeing the car is restored to its unique situation following a collision.

Collision protection is often required by some lenders when financing a sports activities automotive.

Legal responsibility Protection

Legal responsibility protection is prime for any car, together with sports activities vehicles. It protects you financially if you’re at fault in an accident, protecting the opposite social gathering’s damages and medical bills. Sports activities vehicles, with their typically greater efficiency capabilities, could be concerned in accidents with extra vital penalties. Legal responsibility protection supplies a vital security internet in such conditions. This protection is remitted by regulation in most jurisdictions.

Affect on Premiums

The selection of protection choices instantly impacts the general insurance coverage premium. Increased ranges of protection, similar to complete and collision, usually end in the next premium. Nonetheless, these greater premiums typically present higher safety and monetary safety within the occasion of an accident or unexpected injury. The particular options and mannequin of your sports activities automotive, together with the placement of your car, additionally play a job in figuring out your premium.

It’s because sure areas or places could have the next charge of accidents or claims.

Protection Choices Comparability

| Protection Possibility | Description |

|---|---|

| Complete | Covers injury to your sports activities automotive from perils aside from collisions, similar to vandalism, theft, hearth, hail, or climate occasions. |

| Collision | Covers injury to your sports activities automotive within the occasion of a collision, no matter who’s at fault. |

| Legal responsibility | Covers damages and medical bills for different events concerned in an accident the place you might be at fault. |

Evaluating Protection Choices

| Protection Possibility | Advantages | Potential Prices |

|---|---|---|

| Complete | Protects towards a variety of harm, guaranteeing a complete security internet to your sports activities automotive. | Typically greater premiums in comparison with liability-only protection. |

| Collision | Covers restore or alternative of your car in case of a collision, no matter fault. | Premiums enhance with this protection in comparison with liability-only. |

| Legal responsibility | Required by regulation in most jurisdictions; protects you financially if you’re at fault in an accident. | Lowest premiums among the many three choices. |

Suggestions for Minimizing Sports activities Automotive Insurance coverage Prices

Securing reasonably priced insurance coverage for a sports activities automotive typically requires proactive measures past merely selecting a supplier. Implementing these methods can considerably scale back premiums, permitting you to take pleasure in your prized possession with no substantial monetary burden. Understanding the components that affect insurance coverage charges and adapting your driving habits and car upkeep can yield substantial financial savings.Efficient methods for minimizing sports activities automotive insurance coverage prices contain a mix of accountable driving, proactive upkeep, and understanding the impression of car modifications.

A meticulous method to those areas can result in substantial financial savings in your insurance coverage premiums.

Sustaining a Good Driving Report

A clear driving document is paramount in securing favorable insurance coverage charges. Avoiding site visitors violations, significantly rushing tickets and accidents, is essential. Constant adherence to site visitors legal guidelines and defensive driving practices considerably contribute to a constructive driving document, which instantly interprets to decrease insurance coverage premiums. Repeatedly reviewing your driving document for any discrepancies or violations is advisable. By taking proactive steps to keep up a flawless document, you’ll be able to place your self for extra favorable insurance coverage charges.

Methods for Decreasing Insurance coverage Premiums

A number of methods might help scale back your sports activities automotive insurance coverage premiums. These embody exploring reductions supplied by insurance coverage suppliers, similar to multi-policy reductions or good scholar reductions. Sustaining a constant cost historical past is one other key component, demonstrating monetary accountability and doubtlessly incomes favorable remedy from insurance coverage corporations. Moreover, contemplating usage-based insurance coverage packages can lead to decrease premiums primarily based in your precise driving habits.

Enrolling in these packages permits insurance coverage corporations to evaluate your driving patterns and tailor premiums accordingly.

Affect of Including or Eradicating Particular Options

Modifications to your sports activities automotive, similar to efficiency enhancements or aesthetic upgrades, can affect insurance coverage premiums. Insurance coverage suppliers typically take into account the potential for elevated danger related to modifications, which could impression the perceived danger profile of the car. Conversely, eradicating sure efficiency options or customizations might result in a discount within the insurance coverage premium. It is important to debate any modifications along with your insurance coverage supplier to grasp their potential impression in your coverage.

Advantages of Defensive Driving Programs

Collaborating in defensive driving programs can considerably impression your sports activities automotive insurance coverage premiums. These programs equip you with superior driving methods, enhancing your capacity to anticipate and react to doubtlessly hazardous conditions. Improved driving expertise and a proactive method to security translate to a decrease perceived danger profile for insurance coverage corporations. This typically leads to a discount in your insurance coverage premiums.

Significance of Correct Car Upkeep

Sustaining your sports activities automotive meticulously is significant for insurance coverage functions. Common servicing and inspections make sure the car capabilities optimally, minimizing the chance of mechanical failures or accidents. Correct upkeep additionally demonstrates your dedication to car security, which is commonly mirrored in your insurance coverage premiums. By investing in preventative upkeep, you contribute to the longevity and security of your car, and doubtlessly decrease your insurance coverage prices.

Desk of Tricks to Scale back Insurance coverage Premiums for Sports activities Vehicles

| Tip | Rationalization |

|---|---|

| Preserve a clear driving document | Keep away from site visitors violations, particularly rushing and accidents. |

| Discover obtainable reductions | Search for multi-policy reductions or good scholar reductions. |

| Preserve constant cost historical past | Display monetary accountability. |

| Contemplate usage-based insurance coverage | Modify premiums primarily based on precise driving habits. |

| Talk about modifications along with your insurer | Perceive the impression of efficiency or aesthetic adjustments. |

| Full defensive driving programs | Enhance driving expertise and scale back perceived danger. |

| Common car upkeep | Guarantee optimum car perform and security. |

Illustrative Examples of Sports activities Automotive Insurance coverage Insurance policies

Understanding the specifics of sports activities automotive insurance coverage insurance policies is essential for making knowledgeable choices. Completely different insurance policies cater to numerous wants and budgets, and understanding these choices empowers you to pick out the very best match to your car and driving habits.A key facet of sports activities automotive insurance coverage is the tailor-made method. Insurance policies typically incorporate components just like the car’s efficiency capabilities, potential for high-speed driving, and any modifications made to the automotive.

This customized method ensures the premium displays the precise dangers related to the car.

Instance of a Sports activities Automotive Insurance coverage Coverage

Sports activities automotive insurance coverage insurance policies usually supply a spread of protection choices, every with its related price. Premiums can range primarily based on the precise mannequin, modifications, and driving historical past of the insured. This variability necessitates cautious consideration of every issue when choosing a coverage.

Coverage Choices and Prices for Numerous Sports activities Vehicles

The next desk illustrates a hypothetical comparability of insurance coverage prices for various sports activities vehicles, contemplating normal protection. Please observe these are illustrative examples and precise prices will range primarily based on particular person circumstances.

| Sports activities Automotive Mannequin | Estimated Annual Premium (USD) | Protection Particulars |

|---|---|---|

| 2023 Porsche 911 Carrera S | $4,500 | Complete, collision, legal responsibility, uninsured/underinsured motorist, and elective roadside help. |

| 2022 Lamborghini Huracán Evo | $5,200 | Complete, collision, legal responsibility, uninsured/underinsured motorist, and elective high-performance car protection (e.g., engine safety). |

| 2021 BMW M4 Coupe | $3,800 | Complete, collision, legal responsibility, uninsured/underinsured motorist, and elective accident forgiveness. |

Affect of Modifications on Coverage Prices

Modifications to a sports activities automotive can considerably have an effect on insurance coverage premiums. As an illustration, putting in a high-performance exhaust system or a extra highly effective engine can enhance the perceived danger and, consequently, the price of insurance coverage. Equally, putting in specialised racing elements or a roll cage may end in considerably greater premiums.

Hypothetical Sports activities Automotive Insurance coverage Coverage Particulars

This instance Artikels a hypothetical sports activities automotive insurance coverage coverage for a 2022 Chevrolet Corvette Stingray. The coverage contains complete protection, collision protection, legal responsibility protection, and uninsured/underinsured motorist safety. The premium is estimated at $3,200 per yr, primarily based on a clear driving document and normal protection. Modifications, similar to a efficiency exhaust or racing wheels, might enhance this premium.

The coverage additionally options choices for add-ons like roadside help and enhanced safety for particular elements. The small print are as follows:

- Coverage Kind: Complete sports activities automotive insurance coverage

- Car Mannequin: 2022 Chevrolet Corvette Stingray

- Protection Choices: Complete, Collision, Legal responsibility, Uninsured/Underinsured Motorist Safety, Roadside Help

- Estimated Annual Premium: $3,200

- Elements Affecting Premium: Driving document, location, modifications (efficiency components).

Conclusion

In conclusion, discovering the very best automotive insurance coverage to your sports activities automotive entails understanding the distinctive components influencing premiums, evaluating insurance policies from respected suppliers, and implementing methods to attenuate prices. By contemplating all these elements, you’ll be able to guarantee your sports activities automotive is protected whereas protecting your insurance coverage finances in test. Do not get caught in a high-risk scenario with out the correct protection.

Detailed FAQs: Finest Automotive Insurance coverage For Sports activities Vehicles

What if I modify my sports activities automotive?

Modifications, like including aftermarket components, can impression your insurance coverage premiums. Some modifications may enhance your danger, and the insurer may regulate your charge accordingly. It is all the time finest to test along with your insurance coverage supplier to grasp how modifications have an effect on your coverage.

How does my driving document have an effect on my sports activities automotive insurance coverage?

A clear driving document is essential to getting a decrease premium. Accidents or violations can considerably enhance your insurance coverage prices. Sustaining a superb driving historical past is essential for saving cash on sports activities automotive insurance coverage.

What are some widespread misconceptions about sports activities automotive insurance coverage?

A typical false impression is that every one sports activities vehicles have the identical insurance coverage prices. This is not true; the precise mannequin, options, and modifications will play a job. One other widespread false impression is that sports activities automotive insurance coverage is all the time costly. Whereas it could be greater than common, there are methods to buy round and discover higher charges.